Bonds vs Stocks

-

Oct-06-2025

Oct-06-2025

Bonds vs Stocks — A Deep Dive (by Agssl)

When building a resilient investment portfolio, understanding the differences between stocks and bonds—and how each behaves in different market conditions—is key. Below is a deeper exploration, expanding upon the original blog.

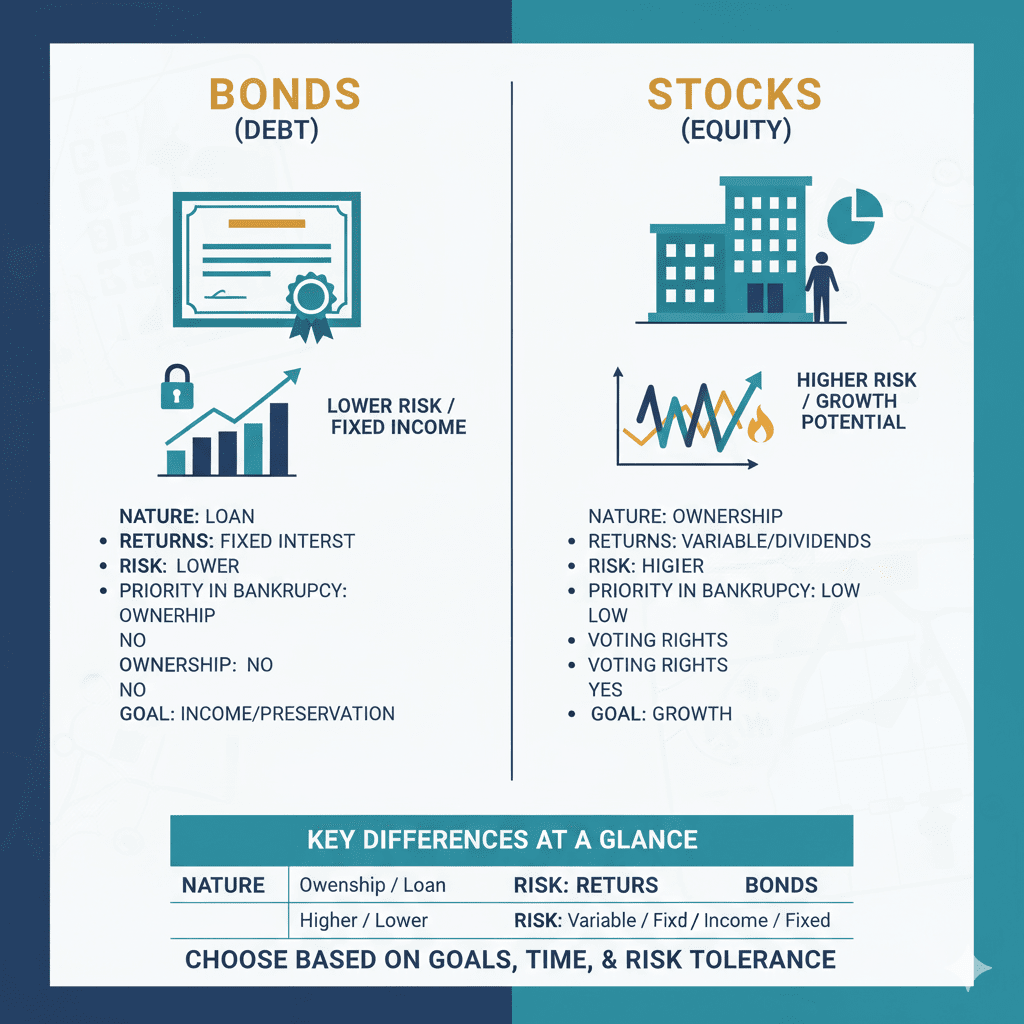

1. Fundamental Concepts

Stocks (Equities)

- Represent ownership in a company.

- Owners are entitled to a share of profits (via dividends, if declared).

- Equity investors may have voting rights on corporate matters (e.g. board elections, major structural changes).

- No fixed maturity — you hold them until you sell (or until the company is acquired or liquidated).

Bonds (Fixed Income / Debt Instruments)

- Represent a loan from investor (bondholder) to issuer (government, corporation, or other).

- Issuers promise to pay periodic interest (coupon payments) and to return principal at a specified maturity date.

- Bondholders generally have no ownership or voting rights.

- The bond contract (the “indenture”) defines the key terms: coupon rate, payment frequency, maturity, covenants, etc.

2. Types and Variants

Types of Stocks

- Common stock — most shares held by public investors. Provides voting rights, variable dividends.

- Preferred stock — hybrid between equity and debt. Preferred shareholders often get fixed dividends and priority over common shareholders in payments, but have limited or no voting rights.

- Growth vs Value Stocks — growth stocks focus on capital appreciation; value stocks are priced lower relative to fundamental metrics (e.g. earnings, book value).

- Large-cap / Mid-cap / Small-cap — categorized by company size and market capitalization.

Types of Bonds

- Government bonds / sovereign bonds — issued by central or national governments (e.g., U.S. Treasuries, Indian Government Securities).

- Municipal bonds (in some countries) — issued by states, cities or other local authorities.

- Corporate bonds — issued by companies.

- Zero-coupon bonds — issued at a discount and do not pay periodic interest; instead, the return is realized at maturity.

- Convertible bonds — corporate bonds that can be converted into equity under certain conditions.

- Floating-rate bonds — interest payments adjust periodically based on a benchmark (e.g. LIBOR, SOFR, a reference rate).

- Callable bonds / Puttable bonds — the issuer or the bondholder may have the right to redeem early under specified conditions.

3. Risk Factors

Equity / Stock Risks

- Market Risk / Volatility — stock prices can swing widely with information, sentiment, macro events.

- Business Risk — poor earnings, management missteps, competitive challenges.

- Dividend Risk — dividends are not guaranteed; in tough economic times a company may reduce or eliminate them.

- Liquidity Risk — in smaller or illiquid stocks, you may not be able to buy/sell quickly without large price impact.

- Sector / Concentration Risk — overexposure to one industry can increase risk.

- Inflation Risk — if inflation runs high, the real return (after inflation) might be low or negative.

Bond / Fixed Income Risks

- Interest-Rate Risk — bond prices move inversely with interest rates. If rates go up, existing bond prices fall (because new bonds may offer better rates).

- Credit Risk / Default Risk — the issuer may fail to meet interest or principal payments (especially for lower-rated bonds).

- Inflation Risk — fixed interest payments may lose real purchasing power in inflationary periods.

- Reinvestment Risk — coupon payments or principal repayments may be reinvested at lower interest rates than originally assumed.

- Liquidity Risk — some bonds, especially those from smaller issuers or in thin markets, may be hard to trade.

- Call Risk / Prepayment Risk — in callable bonds, the issuer may redeem before maturity (usually when interest rates fall), depriving you of future interest income.

4. Returns & Valuation Concepts

Stock Valuation Concepts

- Price-to-Earnings (P/E) ratio, Price-to-Book (P/B), Dividend Yield, PEG ratio, Free Cash Flow metrics.

- Expected returns arise from capital appreciation (increase in share price) + dividends.

- Growth in earnings is a primary driver of long-term returns.

- Market expectations, investor sentiment, macro conditions, interest rates can heavily affect stock valuations.

Bond Valuation Concepts

- A bond’s price is the present value of its future cash flows (coupons + principal) discounted at the prevailing market rate (yield).

- Yield to Maturity (YTM) is the internal rate of return if the bond is held to maturity and all payments occur as scheduled.

- Current yield = (annual coupon) / (current price).

- Yield spread: difference between bond’s yield and a benchmark (e.g. government bond) which reflects credit risk premium.

- As market rates change, bond prices adjust so that their yields align with prevailing rates.

5. Priority & Capital Structure

When a company faces financial distress or bankruptcy:

- Secured creditors (bonds backed by collateral)

- Unsecured bondholders / general creditors

- Preferred shareholders

- Common shareholders

Thus, bond investors have a higher claim on assets than equity investors. This gives bonds a relative cushion in downside scenarios.

6. How They Behave in Market Scenarios

|

Scenario

|

Stocks tend to

|

Bonds tend to

|

|

Economic growth & optimism

|

Perform well (capital appreciation)

|

May underperform equities; bond yields may rise

|

|

Economic slowdown / recession

|

May drop significantly

|

More defensive — investors may flock to bonds, pushing bond prices up (yields down)

|

|

Rising interest rates

|

Negative impact (discounting of future cash flows)

|

Bond prices fall due to interest-rate risk

|

|

Falling interest rates

|

Positive impact (lower required discount rates)

|

Bond prices increase

|

|

High inflation

|

Real returns suffer (especially fixed income)

|

Fixed coupons lose purchasing power

|

7. Strategic Uses & Portfolio Construction

- Diversification: Combining stocks and bonds helps reduce overall portfolio volatility, since they often move differently in varied market conditions.

- Asset allocation based on life stage: Younger investors may lean more toward equities (for growth), whereas those nearing retirement may prefer more bonds (for income & safety).

- Laddering bonds: Investing in bonds with different maturities helps spread interest-rate risk and reinvestment risk.

- Active management or duration control: Adjusting the portfolio’s sensitivity to interest rates (duration) by selecting bonds of different maturities or using bond funds.

- Tactical tilts: Increasing allocation to equities when valuations are attractive or to bonds when markets are stressed.

- Income planning: For investors needing regular income (e.g. retirees), bonds (or income-paying stocks) play a key role.

- Hedging / overlay strategies: Use of derivatives or bonds as a hedge against equity risks.

8. Practical Considerations (in Indian / Emerging Market Context)

- Credit quality: In India (or comparable markets), corporate bond default risk can be significant, so one must pay close attention to credit ratings, issuer financials, covenants, etc.

- Liquidity constraints: Some corporate bonds may trade thinly, causing wide bid-ask spreads.

- Tax treatment: Dividends, interest income, and capital gains may have different tax rates and rules. Investors must understand how taxation impacts net returns.

- Regulatory / policy risk: Changes in interest rate policy by central bank, inflation targeting, or macroeconomic shifts can affect both equity and bond markets.

- Currency risk (for foreign bonds or global equities): Exchange rate fluctuations can add another layer of risk.

9. Example Illustrations

- Suppose a company issues a 5-year bond with a 6% coupon. If market rates rise to 8%, that bond’s market price will fall (so its yield matches prevailing rates).

- A growing company’s stock may reinvest profits and grow earnings at 10–15% annually; early investors often benefit disproportionately.