Stock Split Explained: Meaning, Process, and Impact on Investors

When you start learning about the stock market, you’ll come across terms like bonus issues, buybacks, dividends, and stock splits. Among these, a stock split often raises curiosity because it changes the way a company’s shares are priced and traded—yet the company’s overall valuation remains the same.

This article explores what a stock split is, why companies choose this route, how it impacts investors, and the difference between stock splits and reverse stock splits.

What is a Stock Split?

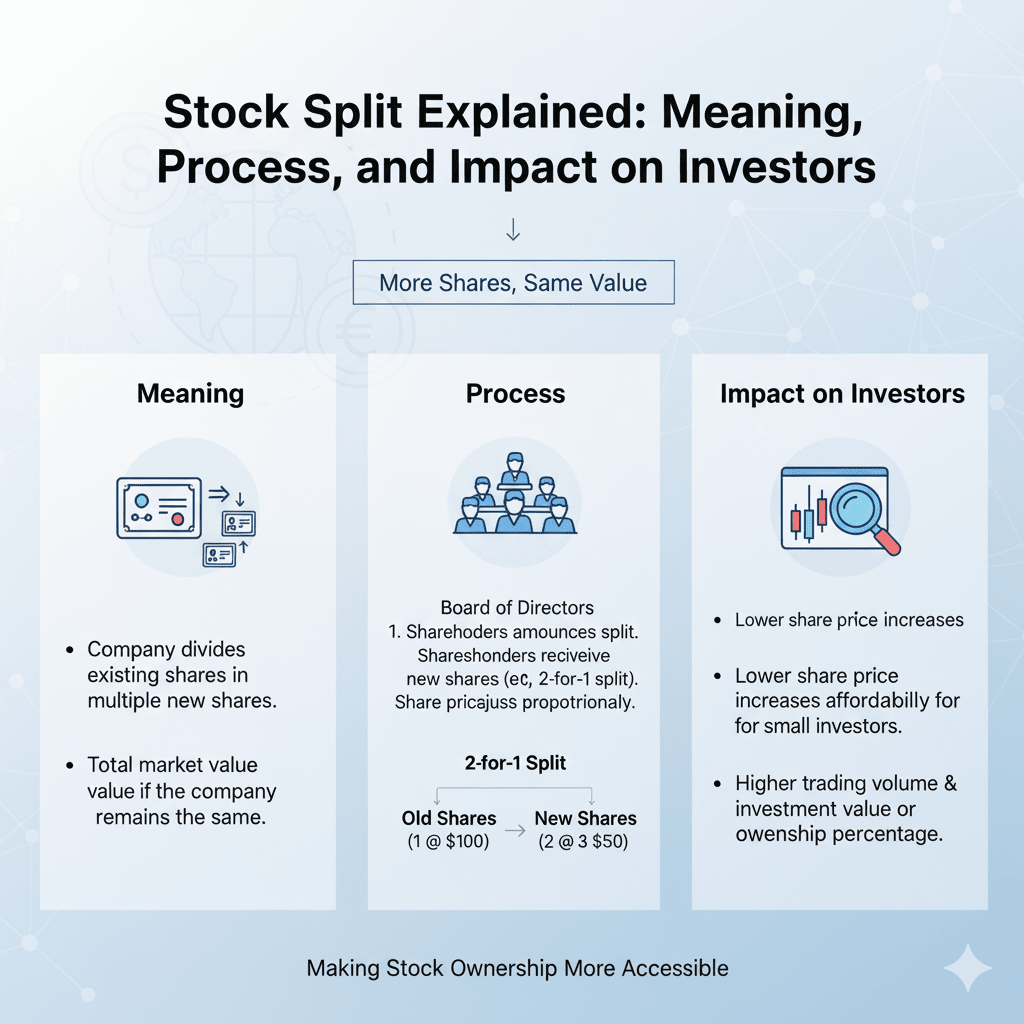

A stock split is a corporate action in which a company divides its existing shares into multiple smaller shares. The face value of each share decreases, while the number of shares increases proportionally.

Despite this change, the company’s overall market capitalization remains the same.

Think of it like exchanging a ₹2,000 note for four ₹500 notes—you have more notes in hand, but the total value of money remains unchanged.

Example of Stock Split

Imagine you hold 10 shares of a company priced at ₹900 each.

Before a 1:2 split

After a 1:2 split

In this case, the share count doubled, and the price halved, but your overall investment value remains unchanged.

Another case: 1:5 split

Why Do Companies Split Their Shares?

Companies announce stock splits for several reasons:

Key Dates in a Stock Split

Two dates play a crucial role in any stock split:

Shares are credited to investors’ demat accounts with a new ISIN (International Securities Identification Number) on the trading day following the record date.

Impact of Stock Split on Futures and Options (F&O)

Stock splits also affect derivative contracts. To maintain fairness, adjustments are made to both price and lot sizes.

This ensures that the overall contract value remains unchanged.

Example:

If a company trades at ₹4,000 with a lot size of 25, and it undergoes a 1:5 split:

Real-Life Case: IRCTC Stock Split

In October 2022, IRCTC announced a 1:5 stock split. Before the split, shares traded near ₹4,500. Post-split, they adjusted to about ₹900.

This made IRCTC’s stock more affordable and significantly boosted liquidity in the market, allowing more retail investors to participate.

Reverse Stock Split (Share Consolidation)

The opposite of a stock split is a reverse split, also known as consolidation. In this process, multiple shares are combined into one, which raises the face value and share price while reducing the number of outstanding shares.

For example, in a 2:1 reverse split:

Reverse splits are often undertaken when a stock price has dropped too low, and the company wishes to improve its market image or comply with exchange regulations.

Advantages and Disadvantages of Stock Splits

Advantages

Disadvantages

Conclusion

A stock split increases the number of shares in circulation while reducing their face value and market price. The total value of an investor’s holding remains unchanged.

While stock splits make shares more affordable and improve liquidity, they do not alter the company’s underlying fundamentals. Investors should see stock splits as a cosmetic adjustment for accessibility, not as a guarantee of higher profitability.

Ultimately, long-term success still depends on the company’s business model, earnings growth, and market position.

Stock Split Explained: Meaning, Process, and Impact on Investors

When you start learning about the stock market, you’ll come across terms like bonus issues, buybacks, dividends, and stock splits. Among these, a stock split often raises curiosity because it changes the way a company’s shares are priced and traded—yet the company’s overall valuation remains the same.

This article explores what a stock split is, why companies choose this route, how it impacts investors, and the difference between stock splits and reverse stock splits.

What is a Stock Split?

A stock split is a corporate action in which a company divides its existing shares into multiple smaller shares. The face value of each share decreases, while the number of shares increases proportionally.

Despite this change, the company’s overall market capitalization remains the same.

Think of it like exchanging a ₹2,000 note for four ₹500 notes—you have more notes in hand, but the total value of money remains unchanged.

Example of Stock Split

Imagine you hold 10 shares of a company priced at ₹900 each.

Before a 1:2 split

After a 1:2 split

In this case, the share count doubled, and the price halved, but your overall investment value remains unchanged.

Another case: 1:5 split

Why Do Companies Split Their Shares?

Companies announce stock splits for several reasons:

Key Dates in a Stock Split

Two dates play a crucial role in any stock split:

Shares are credited to investors’ demat accounts with a new ISIN (International Securities Identification Number) on the trading day following the record date.

Impact of Stock Split on Futures and Options (F&O)

Stock splits also affect derivative contracts. To maintain fairness, adjustments are made to both price and lot sizes.

This ensures that the overall contract value remains unchanged.

Example:

If a company trades at ₹4,000 with a lot size of 25, and it undergoes a 1:5 split:

Real-Life Case: IRCTC Stock Split

In October 2022, IRCTC announced a 1:5 stock split. Before the split, shares traded near ₹4,500. Post-split, they adjusted to about ₹900.

This made IRCTC’s stock more affordable and significantly boosted liquidity in the market, allowing more retail investors to participate.

Reverse Stock Split (Share Consolidation)

The opposite of a stock split is a reverse split, also known as consolidation. In this process, multiple shares are combined into one, which raises the face value and share price while reducing the number of outstanding shares.

For example, in a 2:1 reverse split:

Reverse splits are often undertaken when a stock price has dropped too low, and the company wishes to improve its market image or comply with exchange regulations.

Advantages and Disadvantages of Stock Splits

Advantages

Disadvantages

Conclusion

A stock split increases the number of shares in circulation while reducing their face value and market price. The total value of an investor’s holding remains unchanged.

While stock splits make shares more affordable and improve liquidity, they do not alter the company’s underlying fundamentals. Investors should see stock splits as a cosmetic adjustment for accessibility, not as a guarantee of higher profitability.

Ultimately, long-term success still depends on the company’s business model, earnings growth, and market position.