Futures contracts are standardized agreements to buy or sell an asset at a predetermined price on a future date. They’re widely used for hedging risk and leveraged trading. In India, futures trading happens on regulated exchanges like NSE and BSE.

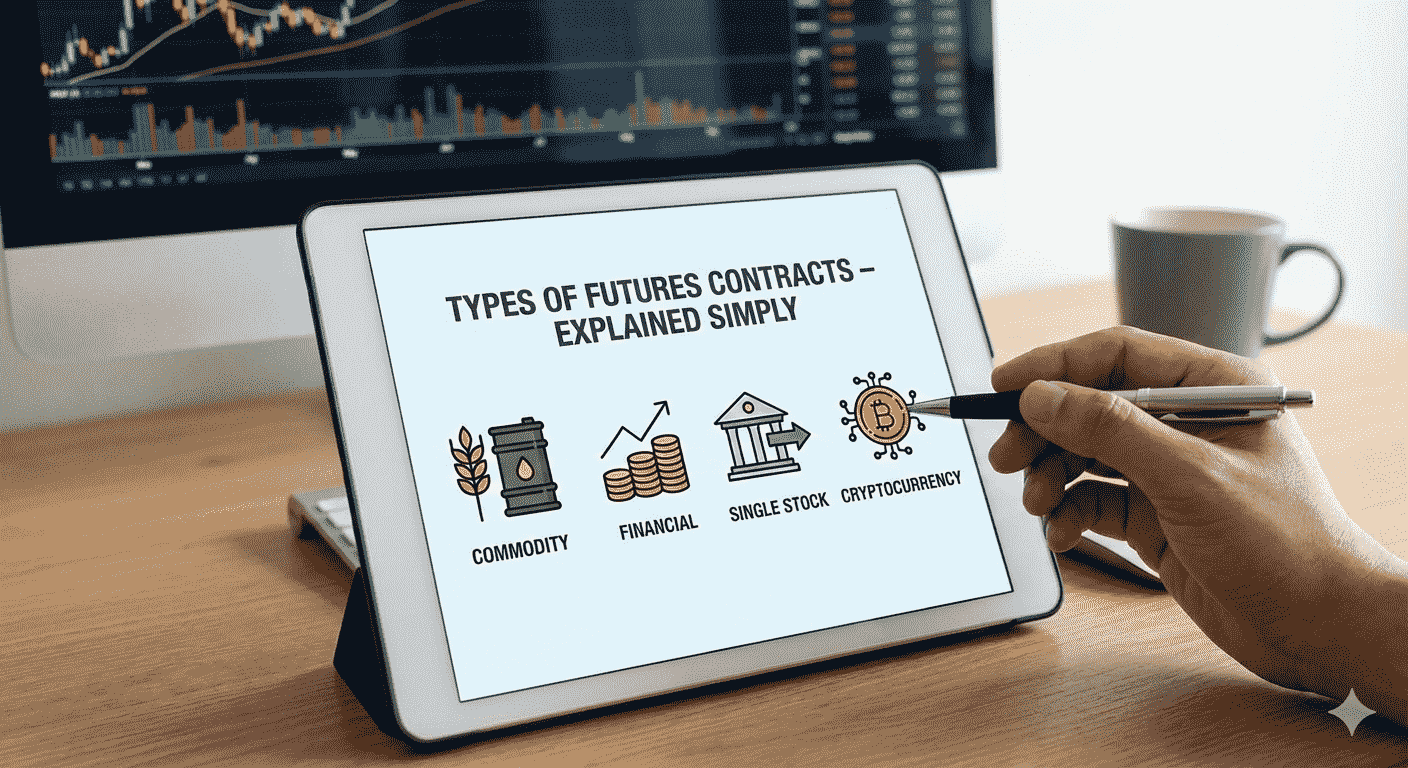

Let’s break down the main types of futures contracts—no fluff, just fundamentals.

Commodity futures are contracts based on physical goods.

Examples:

Gold, Silver, Crude Oil, Natural Gas, Wheat, Cotton

Who uses them:

Farmers & producers → hedge price risk

Traders → speculate on price movement

Why it matters:

They help stabilize income and protect against volatility in commodity prices.

Index futures are linked to a stock market index.

Examples:

NIFTY 50, BANK NIFTY, FINNIFTY

Who uses them:

Institutional investors

Active traders & hedgers

Why it matters:

You get market-wide exposure without buying individual stocks. High liquidity, lower impact cost—big efficiency play.

Stock futures are contracts based on individual stocks.

Examples:

Reliance, TCS, HDFC Bank, Infosys

Who uses them:

Traders with directional views

Portfolio hedgers

Why it matters:

Allows leveraged exposure to a stock with lower upfront capital compared to cash market.

Currency futures track exchange rates between currency pairs.

Examples:

USD/INR, EUR/INR, GBP/INR, JPY/INR

Who uses them:

Importers & exporters

Currency traders

Why it matters:

Helps manage forex risk and protect against exchange-rate volatility.

These futures are linked to interest-bearing instruments.

Examples:

Government bonds, T-Bills

Who uses them:

Banks

Financial institutions

Why it matters:

Used to hedge against changes in interest rates impacting bond prices and borrowing costs.

Hedging against price risk

High liquidity

Leverage amplifies capital efficiency

Transparent and regulated market

Leverage can magnify losses

Mark-to-market daily settlement

High volatility requires strict risk management

Futures contracts are powerful financial instruments when used strategically. Whether you’re hedging exposure or trading trends, understanding the type of future you’re dealing with is non-negotiable. Risk first, returns next—that’s the playbook.