Bermuda Option: A Hybrid Derivative for Strategic Flexibility

Introduction

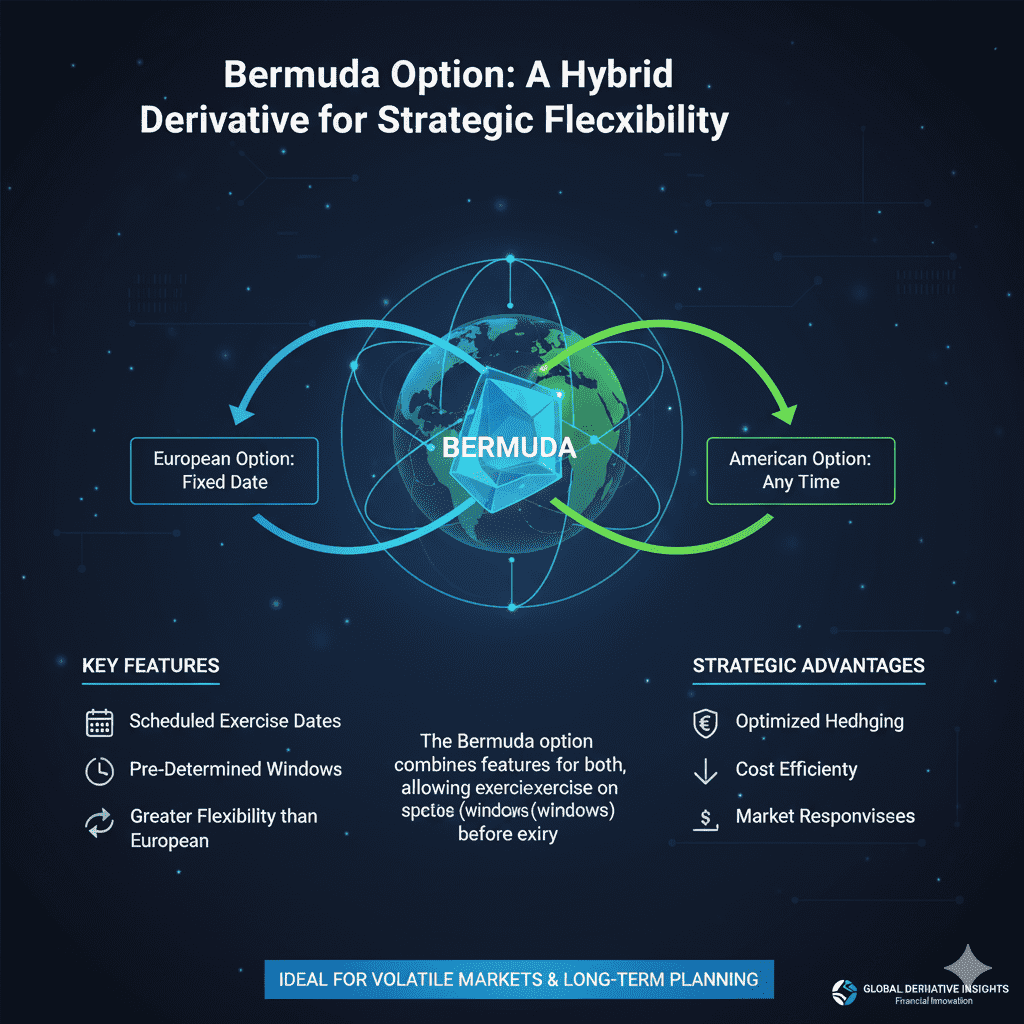

India’s derivatives market has evolved rapidly, offering investors and institutions diverse ways to hedge and speculate. Among the various option types, the Bermuda Option—also known as the Bermudan Option—stands out for offering limited flexibility with controlled cost.

It sits strategically between European and American options, allowing the holder to exercise on pre-decided dates before expiry, not anytime. This makes it a valuable tool for advanced traders and corporates looking to time their hedging decisions more efficiently.

What Is a Bermuda Option?

A Bermuda option is a contract that gives its holder the right (but not obligation) to buy or sell an underlying asset at a predetermined price (strike price), but only on specific dates listed in the contract or on the final expiration date.

It is:

So, the Bermuda option provides a structured middle path, balancing flexibility and cost efficiency.

Mechanics of a Bermuda Option

Example Scenario

Imagine a corporate treasurer in India expecting USD inflows over the next six months.

They buy a Bermuda Put Option on USD/INR with the right to sell USD at ₹83.00 on any month-end date before expiry.

This timing control helps manage forex risk dynamically — something a European option cannot offer.

Advantages of Bermuda Options

Controlled Flexibility

Exercise only on specific dates — ideal when key market events are predictable.

Cost Efficiency

Premiums are lower than American options due to limited exercise rights.

Strategic Hedging Tool

Perfect for corporates expecting cash flows or asset revaluations at known intervals.

Customisation

Can be structured for specific needs — currencies, commodities, or interest-rate products.

Better Time Value Management

Holders can lock in profits mid-term without waiting till final expiry.

Disadvantages and Risks

Limited Liquidity

Bermuda options are generally OTC products, so secondary market trading is rare.

Complex Valuation

Requires advanced pricing models and access to institutional-grade analytics.

Regulatory and Counterparty Risks

As OTC contracts, they rely on the credibility of the counterparty.

Timing Constraints

If favourable price movement happens outside the scheduled exercise dates, the holder cannot capitalize on it.

Not for Beginners

Best suited for professionals or corporates with hedging experience.

Bermuda Options vs. European and American Options

|

Feature |

European Option |

Bermuda Option |

American Option |

|

Exercise Timing |

Only on expiry |

On specific dates + expiry |

Any time before expiry |

|

Flexibility |

Low |

Moderate |

High |

|

Premium Cost |

Lowest |

Medium |

Highest |

|

Liquidity |

High |

Low |

High |

|

Best For |

Passive investors |

Strategic hedgers |

Active traders |

|

Availability in India |

Widely traded |

Rare (OTC) |

Limited (some commodity & index options) |

Bermuda Options in the Indian Market

In India, exchange-traded derivatives (like those on NSE or BSE) are typically European style. Bermuda options appear mainly in the institutional and interbank markets, used for:

Under Indian regulations:

Real-World Application: Example Use Cases

Pricing of Bermuda Options

Pricing is complex since it depends on:

The valuation combines principles from American options (early exercise) and European options (fixed expiry) using multi-period models.

Institutions typically rely on quantitative models or Bloomberg terminals for correct pricing.

Tax and Compliance Considerations (India)

Retail investors should consult tax and compliance experts before engaging in such trades.

Key Takeaways

Conclusion

The Bermuda Option bridges the gap between American and European options, making it an intelligent choice for sophisticated traders who need flexibility at scheduled intervals.

While still niche in India, awareness of such instruments helps investors grasp how global markets hedge risk with precision and timing. As India’s financial ecosystem becomes more advanced, hybrid derivatives like Bermuda options could soon find a place in mainstream hedging strategies.