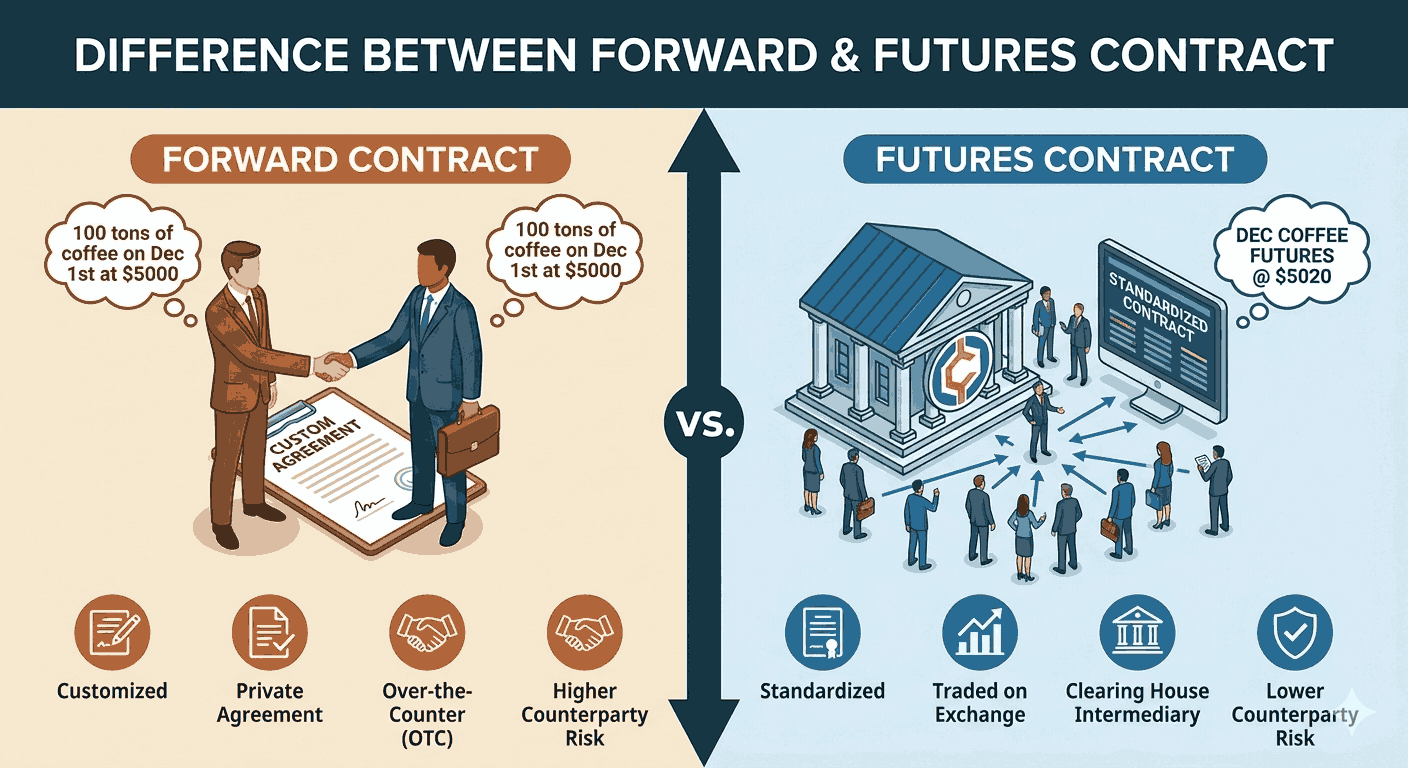

In the derivatives ecosystem, forward and futures contracts are core risk-management tools. While both aim to hedge price volatility, their structure, risk profile, and execution model are fundamentally different. Let’s break it down — no fluff, just signal.

A forward contract is a customized agreement between two parties to buy or sell an asset at a fixed price on a future date.

Traded over-the-counter (OTC)

Fully customizable (price, quantity, date)

No daily settlement

Higher counterparty risk

Typically used by corporates and institutions

Use Case:

Importers/exporters locking in exchange rates to hedge currency risk.

A futures contract is a standardized agreement traded on a recognized exchange to buy or sell an asset at a future date at a predetermined price.

Traded on regulated exchanges

Standardized contracts

Daily mark-to-market settlement

Backed by clearing corporation

High liquidity and transparency

Use Case:

Retail and institutional traders hedging or speculating in commodities, indices, or stocks.

| Basis | Forward Contract | Futures Contract |

|---|---|---|

| Trading Platform | OTC (Private) | Exchange-Traded |

| Contract Size | Custom | Standardized |

| Counterparty Risk | High | Very Low |

| Settlement | On Maturity | Daily MTM |

| Liquidity | Low | High |

| Regulation | Unregulated | Highly Regulated |

| Margin Requirement | No | Mandatory |

Pros

Fully tailored contracts

Ideal for long-term hedging

Cons

Counterparty default risk

Low liquidity

Pros

Transparent pricing

High liquidity

Reduced credit risk

Cons

Less flexibility

Daily margin obligations

Choose Forward Contracts if:

You are a corporate hedger

You need customization

You’re managing long-term exposure

Choose Futures Contracts if:

You’re an active trader

You want liquidity and transparency

You need regulated risk management

At AGSSL, we simplify complex market instruments into actionable insights. Whether you’re hedging risk or scaling trading strategies, our knowledge center keeps you market-ready — always.

📩 For queries or expert support: info@agssl.in

🌐 Stay ahead. Trade smarter. Scale faster.