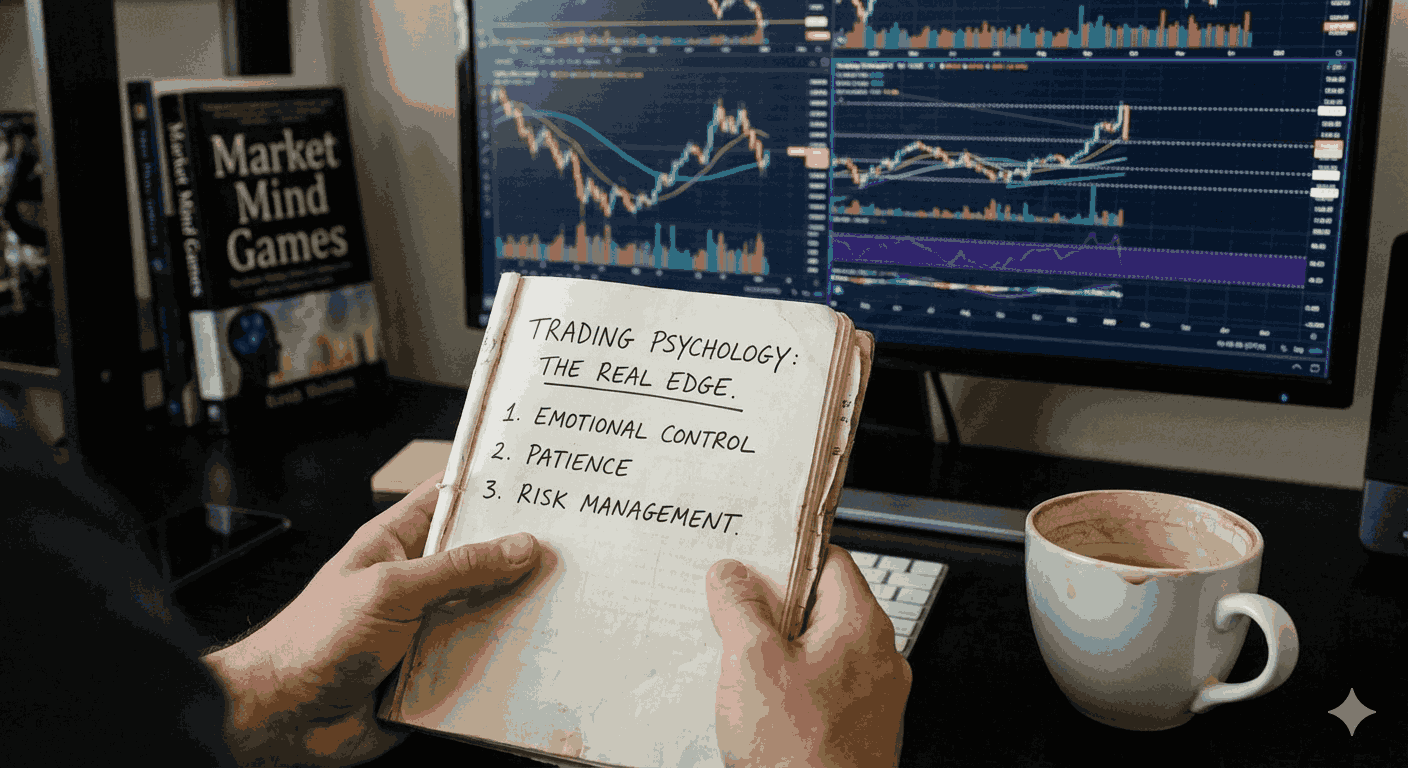

Trading isn’t just charts, indicators, or strategies — it’s a mindset game. Most traders don’t lose money because of bad analysis; they lose because emotions hijack execution. Welcome to the real alpha: trading psychology.

What Is Trading Psychology?

Trading psychology refers to the emotional and mental state that drives trading decisions. Fear, greed, overconfidence, and impatience directly impact entry, exit, and risk management. If not controlled, they erode even the best strategy.

Bottom line: strategy gets you in the game, psychology keeps you profitable.

Why Trading Psychology Matters

Markets are volatile, unpredictable, and fast-moving. Emotional reactions lead to:

Overtrading

Revenge trading

Holding losses too long

Exiting winners too early

Professional traders focus on process over outcomes. Discipline beats prediction. Always.

Key Psychological Challenges Traders Face

1. Fear

Fear of loss causes hesitation and early exits. This results in missed opportunities and inconsistent returns.

Fix: Predefine risk. Trust the plan. Execute without second-guessing.

2. Greed

Greed pushes traders to over-leverage, ignore stop-losses, and chase momentum.

Fix: Set realistic targets. Stick to position sizing rules.

3. Overconfidence

A winning streak can inflate ego and reduce discipline.

Fix: Markets don’t care about past wins. Treat every trade independently.

4. Loss Aversion

Traders hold losing positions hoping for reversal, avoiding the pain of booking losses.

Fix: Losses are business expenses. Cut fast, move on.

5. Impatience

Entering trades without confirmation or deviating from strategy.

Fix: Wait for high-probability setups. No setup = no trade.

How to Build Strong Trading Psychology

Have a Trading Plan

A clear plan defines:

Entry & exit rules

Risk per trade

Capital allocation

No plan = emotional trading.

Risk Management Is Non-Negotiable

Never risk more than you can afford to lose. Use stop-losses religiously.

Risk control > profit chasing.

Maintain a Trading Journal

Track:

Trades taken

Emotional state

Mistakes & learnings

This builds self-awareness and long-term consistency.

Focus on Long-Term Performance

Short-term losses are noise. Consistency over time is the KPI that matters.

Detach Emotion from Money

Think in probabilities, not rupees. Trading is a numbers game, not an emotional one.

Final Take

Trading psychology is your competitive advantage. Master your mindset, and strategies start working as intended. Ignore it, and even perfect analysis collapses under pressure.

The market rewards discipline, patience, and emotional control — every single time.