Beginning your investment journey can be both exciting and intimidating. The thrill of making your money grow often comes with uncertainty and inexperience. Many new investors step into the stock market full of enthusiasm but fall into predictable traps that can slow — or even derail — their progress.

By understanding these common investment mistakes early, you can make smarter decisions and build a solid foundation for sustainable financial growth.

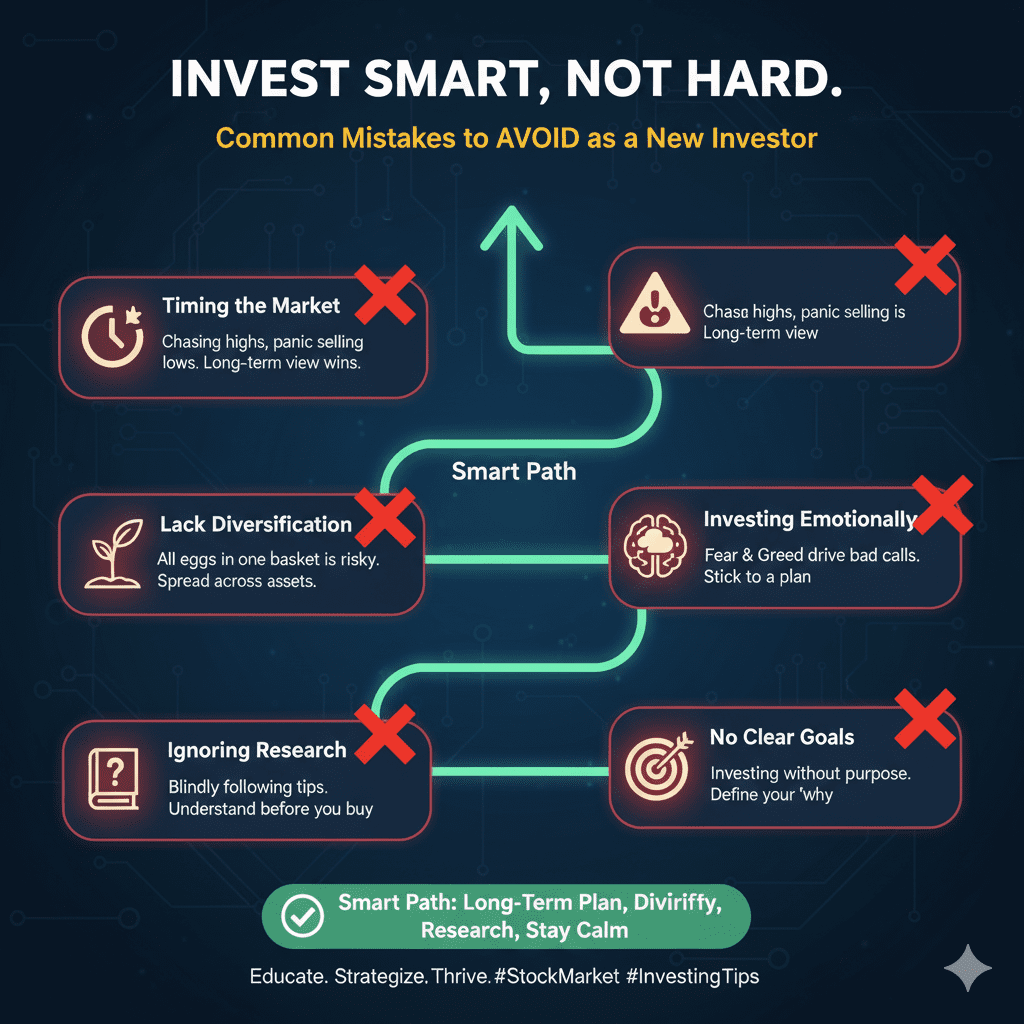

One of the biggest mistakes beginners make is jumping into investments without understanding what they’re buying.

Before investing in any company, mutual fund, or asset, take time to study its business model, financial performance, and future prospects. Relying solely on market rumors or tips can lead to poor choices and unexpected losses.

👉 Tip: Always read company reports, analyze fundamentals, and understand the market segment before investing.

Putting all your money into a single stock or sector is like walking a tightrope without a safety net. Diversification spreads your investments across multiple asset classes — such as equities, bonds, gold, and mutual funds — reducing overall risk.

A balanced portfolio ensures that even if one sector underperforms, others can offset the loss.

👉 Example: If your tech stocks drop, your investments in FMCG or banking might remain stable and protect your capital.

Many beginners believe they can “buy low and sell high.” In reality, even seasoned professionals struggle to time the market accurately. Constantly entering and exiting trades based on short-term market swings usually leads to missed opportunities and emotional stress.

👉 Better Approach: Stay consistent with your investment plan, use SIPs (Systematic Investment Plans) for regular investing, and focus on long-term wealth creation.

Fear and greed are the twin emotions that drive most investment blunders. Selling in panic during a market dip or chasing hype during a rally often results in losses. The key to success lies in discipline — sticking to your strategy even when markets are volatile.

👉 Reminder: Emotional investing is often impulsive investing. Logic should always win over instinct.

Every investor has a different comfort level with risk. A young professional can afford to take higher risks compared to someone nearing retirement. Investing without considering your risk profile, time horizon, and goals can lead to regret and financial strain.

👉 Action Step: Set clear financial goals — short, medium, and long term — and choose investment options that align with each.

Smart investors always plan for the unexpected. Tools like stop-loss orders, hedging, or asset rebalancing can protect your capital from sudden downturns. Ignoring these measures can turn small losses into major setbacks.

👉 Pro Tip: Review and rebalance your portfolio at least once every six months.

It’s easy to be influenced by friends, social media, or “market gurus.” But every investor’s journey is unique. What works for one person may not suit your risk profile or goals. Always do your own analysis and trust verified information before taking any decision.

👉 Rule: Follow knowledge, not noise.

Investing isn’t a race; it’s a marathon. Patience, consistent learning, and disciplined execution are what separate successful investors from the rest. Avoiding these common mistakes can help you build a resilient, diversified portfolio that grows steadily over time.

Remember, smart investing isn’t about timing the market — it’s about time in the market.

Ready to start your investment journey the right way?

Join hands with AG Shares & Securities Ltd., your trusted partner in financial growth.

Let’s turn your goals into long-term success.