How to Pick the Best Stocks for Intraday Trading: A Complete Guide

Intraday trading, also known as day trading, is a popular method of market speculation where

traders buy and sell stocks within the same trading day. The goal is simple: take advantage of small

price movements to earn quick profits. But there's one golden rule that can make or break your

intraday trading success - stock selection.

Let's break down the key strategies and insights that will help you pick the best stocks for intraday

trading.

What is Intraday Trading?

In intraday trading, positions are opened and closed within the same day. For instance, if you buy

500 shares of Reliance at Rs.920 in the morning and sell them at Rs.928 by evening, you make a

profit of Rs.4,000 (500 x Rs.8). You can also short sell, i.e., sell first and buy later, to profit from

falling prices - a practice only possible through intraday trading.

Why Stock Selection Matters in Intraday Trading

Many traders fail to make profits because they pick the wrong stocks. Success depends on choosing

liquid, predictable, and volatile (but not overly erratic) stocks that respond to market trends and

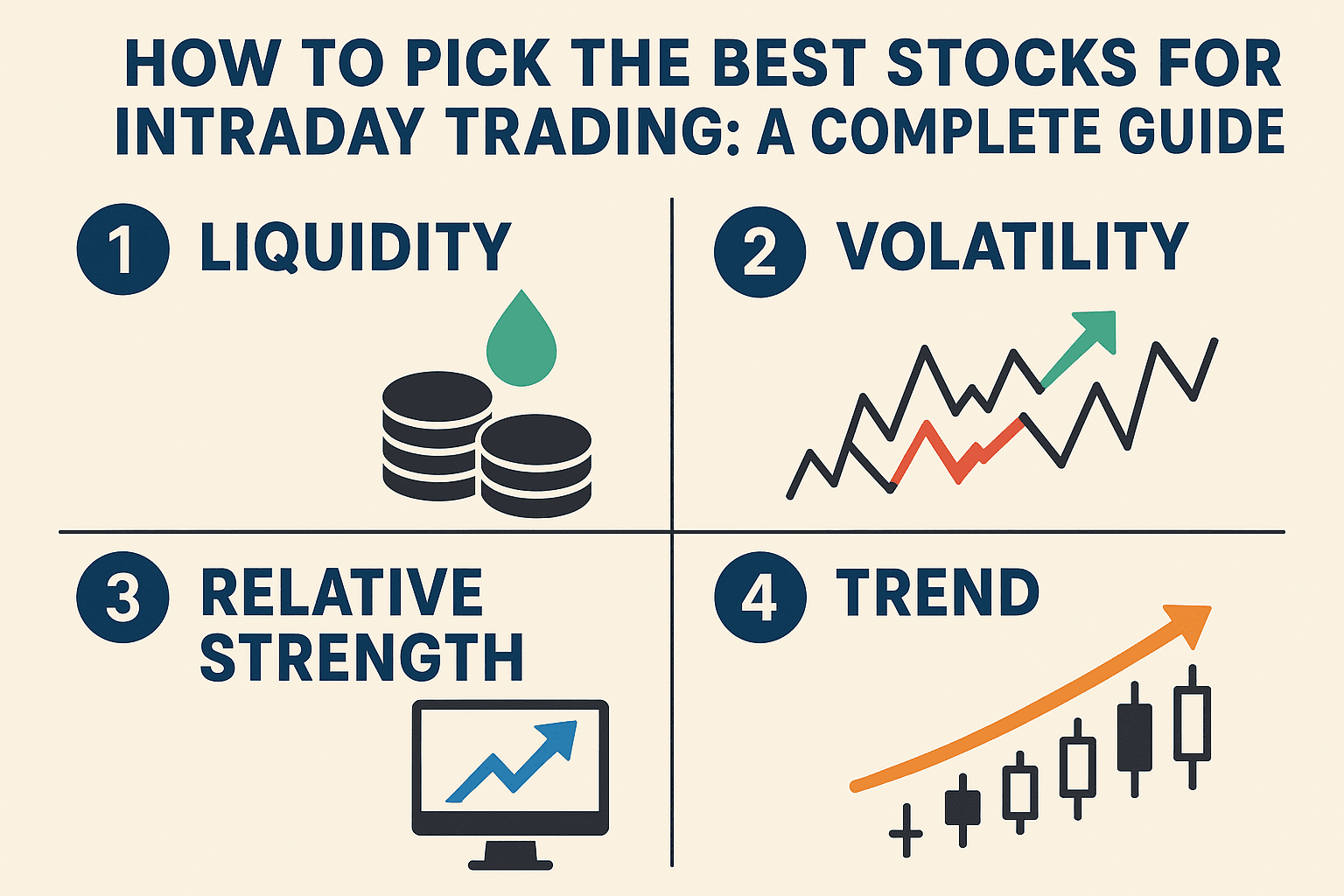

news. Here are the key factors you must consider:

1. Trade Only in Liquid Stocks

Liquidity refers to how easily a stock can be bought or sold without impacting its price.

- Highly liquid stocks have large trading volumes, allowing traders to enter and exit positions with

ease.

- Illiquid stocks often lack enough buyers or sellers, making it hard to complete trades or causing

large price changes for even small orders.

Tip: Look for stocks that trade at least 50,000 to 75,000 shares per day if the price is between Rs.50

to Rs.100. For higher value stocks, you'll need even more volume.

Also, check liquidity at various price levels. A stock may be liquid at Rs.100 but illiquid at Rs.120.

Monitor such behavior to make smarter entries and exits.

2. Avoid Highly Volatile Stocks

Stocks with low volume or those affected by sudden news events can behave unpredictably. While

some volatility is essential for profit opportunities, too much can spell disaster.

- Most intraday traders look for stocks that move 3-5% in a day - not more.

- Avoid penny stocks and low-cap segments (like S, T, and Z groups), which often have both low

volume and high unpredictability.

3. Trade in Stocks with Good Correlation to Indices

Stocks that move in sync with their sector or index offer more predictability.

For example:

- A strengthening rupee might hurt IT stocks due to lower export earnings.

- Similarly, a surge in oil prices may impact aviation stocks.

Choose stocks that reflect the sentiment of their sector or the broader market for more reliable

trends.

4. Follow the Trend

Always trade with the trend, not against it.

- In a bull market, pick rising stocks.

- In a bear market, look for stocks that are declining and consider short selling.

Trend-based trading reduces risk and improves your chances of success.

5. Do Your Research

Good research is the backbone of profitable trading.

Here's a step-by-step strategy:

1. Identify the market trend - bullish or bearish.

2. Choose sectors showing strength or weakness.

3. Pick stocks within those sectors that show good volume and liquidity.

4. Use technical analysis - study support, resistance, and price action.

5. Check fundamentals and news triggers for extra insights.

Don't just follow tips or social media. Build your watchlist through data-backed analysis.

6. Check the Following Technical Criteria

a. Liquidity Ratio

- Use this formula: Liquidity = Average Daily Volume / Market Capitalization

- Look for a minimum 10% liquidity ratio to ensure smooth trade execution.

b. Impact Cost

- Impact cost is the price effect of placing a large buy or sell order.

- Low impact cost = better entry/exit prices.

c. Widely Owned Stocks

- Stocks with broad ownership are less prone to manipulation.

- Avoid stocks cornered by a few big players - they can hit circuit limits fast.

d. Narrow Tick Spread

- A smaller gap between buy and sell prices (ticks) means better pricing.

- In intraday trades, wide spreads can eat into profits quickly.

e. Clear Chart Patterns

- Look for stocks with visible trends or repeating patterns.

- Avoid stocks with inconsistent or unclear chart histories.

f. Sensitivity to News

- Good intraday stocks react quickly to earnings reports, economic indicators, or global events.

- This lets you capitalize on buy-on-rumor, sell-on-news strategies.

How to Pick Stocks Daily?

Here are some daily habits and filters to help you pick the right stocks:

- High Volume Stocks - Focus on shares with significant daily trading activity.

- News-Driven Stocks - Stocks with expected announcements or news events.

- Weekly Trends - Watch stocks showing consistent movement over the past 5 days.

- Breakout Stocks - Those breaching resistance levels with strong momentum.

- Stick to a Few Favorites - Master 5-10 stocks by tracking them daily.

- Watch Top Gainers/Losers - Use these lists to identify momentum trades.

Conclusion

Intraday trading is not just about speed - it's about strategy, discipline, and stock selection. The best

traders focus on:

- Liquidity

- Trend alignment

- Clear patterns

- News sensitivity

Over time, you'll train your eye to spot the right opportunities. Rely on technical analysis, ignore

emotional biases, and stick to data-driven decisions. With practice, your ability to pick the best

intraday stocks will become your greatest edge in the market.

AGSSL Tip: Use advanced trading platforms like AGSSL's Online Terminal to monitor stocks in

real-time, execute faster trades, and stay ahead of market moves - all from your browser.

Disclaimer: Intraday trading involves risk. Please consult with a financial advisor before investing.