Complete Guide to the IPO Process in India: From Private to Public

Introduction: Why Do Companies Go Public?

An Initial Public Offering (IPO) is a major milestone in a company’s growth journey. It marks the transition of a privately held company into a publicly traded one, giving the general public an opportunity to invest in its shares. But the IPO journey is not just about selling shares — it’s about raising capital, building credibility, enhancing liquidity, and gaining access to wider financial markets.

The process of launching an IPO in India is comprehensive, highly regulated by the Securities and Exchange Board of India (SEBI), and must follow a structured, step-by-step path. If you’re a business owner considering an IPO or an investor wanting to understand the process, this guide is for you.

Key Reasons Companies Choose to Go Public

1. Raise Capital for Expansion

The primary motivation for going public is to raise significant capital to fund business growth — whether it’s expanding into new markets, launching new products, acquiring other companies, or simply reducing debt.

2. Increase Brand Credibility and Visibility

IPO listing boosts the public image of a company. It signals transparency and financial maturity, helping to build trust among customers, suppliers, and potential business partners.

3. Liquidity for Existing Investors

Private shares are illiquid and hard to trade. IPOs allow existing shareholders — founders, early investors, and employees — to convert their holdings into tradable shares, unlocking value and enabling exits.

4. Establish Market Value

When a company lists on the stock exchange, the market determines its value through share pricing and trading activity. This market-based valuation can assist in future fundraising, partnerships, and strategic decisions.

5. Access to Broader Financial Instruments

Once listed, a company can explore multiple fundraising routes beyond equity — including debt offerings, convertible securities, and rights issues. This opens up long-term strategic financial flexibility.

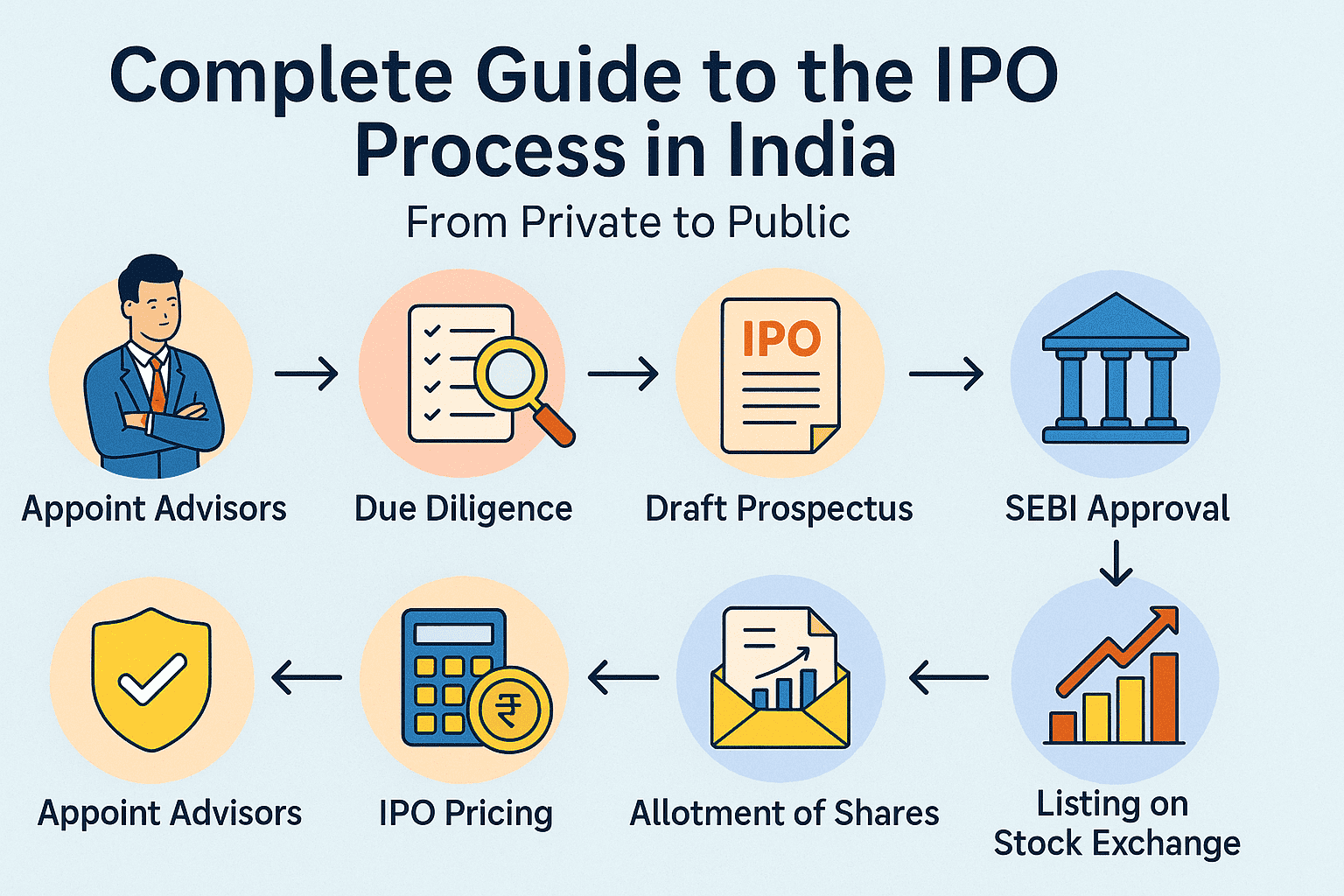

The IPO Process in India: A Step-by-Step Overview

Launching an IPO is a complex journey, typically taking 6–9 months, and involving several stakeholders, including legal advisors, auditors, merchant bankers, and market regulators. Here's a step-by-step breakdown:

Step 1: Appoint an Investment Bank or Underwriter

The first move is to hire one or more investment banks or underwriters. Their role is to evaluate the company’s financial health, determine capital requirements, structure the IPO, and assist in regulatory filings. They also take part in pricing the shares and marketing the IPO.

An underwriting agreement is signed that outlines the amount to be raised, types of securities to be issued, and responsibilities of all parties involved.

Step 2: Prepare DRHP and File with SEBI

The company and its advisors prepare a Draft Red Herring Prospectus (DRHP), a detailed legal document that includes:

Financial statements

Industry overview

Business and operational details

Promoter and management info

Risk factors and litigation history

Proposed use of IPO proceeds

The DRHP is submitted to SEBI and the Registrar of Companies (RoC). SEBI reviews it for compliance with the SEBI ICDR Regulations, and if required, returns it with comments for clarification or changes.

Once approved, the company can fix the IPO timeline and proceed to market the issue.

Step 3: Apply to Stock Exchanges

The company must now decide where it wants to list — typically on the NSE or BSE — and file the application accordingly. Exchange approval is mandatory for listing.

Step 4: Conduct Roadshows and Marketing

Next comes the roadshow phase — typically lasting 1 to 2 weeks — where senior management and investment bankers travel across cities, meeting with institutional investors like Qualified Institutional Buyers (QIBs).

This step helps generate buzz, build credibility, and gauge investor interest. The company showcases:

Growth story and future plans

Financial performance

Competitive advantages

Reasons to invest

Roadshows may be physical or virtual, and the feedback collected helps finalize pricing.

Step 5: Pricing the IPO – Fixed vs Book-Building

Companies can choose from two pricing mechanisms:

Fixed Price Issue

The price per share is decided in advance and disclosed in the prospectus. Investors know what they are paying at the time of application.

Book-Building Issue

A price band is provided (e.g., ₹100–₹120). Investors bid for shares within this range, and the final price is determined by demand. This method is preferred as it leads to better price discovery and more transparent allocation.

The final price is called the cut-off price, and shares are allocated accordingly.

Step 6: Offer Opens to the Public

Once pricing is finalized, the IPO opens for subscription — typically for 3 to 5 working days. Applications can be submitted online or offline through ASBA (Application Supported by Blocked Amount) via banks and brokers.

SEBI regulates IPO timing to avoid overlap with large competing offerings and to ensure retail investor protection.

Retail investors, QIBs, and Non-Institutional Investors (NIIs) all participate in different reserved quotas.

Step 7: Share Allotment and Listing on the Exchange

After the subscription window closes:

Applications are verified

Shares are allotted based on demand

Refunds are issued to non-allottees (in oversubscribed cases)

Shares are credited to investor demat accounts

Oversubscription is common. For instance, if the IPO is oversubscribed 5x, investors may receive only 20% of the shares they applied for.

The company then finalizes its listing date. On this day, its shares begin trading on the exchange.

Lock-In Periods and Post-IPO Market Dynamics

SEBI enforces a lock-in period for promoters and select investors, typically ranging from 6 months to 3 years, to prevent immediate stock dumping that could destabilize prices.

When the lock-in ends, short-term fluctuations may occur as shares hit the open market.

Also, IPO stock prices may fluctuate after listing, depending on market sentiment, investor perception, and broader economic trends.

Conclusion: IPO as a Strategic Growth Lever

Launching an IPO is not just a financial decision — it’s a strategic transformation. It requires transparency, operational excellence, and investor confidence. While the rewards are high — capital, credibility, liquidity — the risks are also significant if the process is not managed carefully.

If you're an investor or a business looking to understand the IPO journey, staying informed is key.

For detailed IPO reviews, latest listings, and company analysis, visit Agssl’s IPO review section.

Frequently Asked Questions (FAQs)

Q1. What is the difference between DRHP and RHP?

DRHP (Draft Red Herring Prospectus) is the initial filing with SEBI, while RHP (Red Herring Prospectus) is the final version issued before the IPO opens to the public.

Q2. Who can invest in an IPO?

Retail investors, QIBs (like mutual funds and banks), and Non-Institutional Investors (HNIs) can all apply for IPO shares.

Q3. What is oversubscription in IPOs?

It means more demand than available shares. In such cases, allotment is made proportionately or by lottery (in retail category).

Q4. How long does it take to go public in India?

Typically, 6–9 months, but it can vary depending on regulatory approvals and market readiness.