An Initial Public Offering (IPO) is a significant opportunity for investors to participate in a company's growth by purchasing shares before they are listed on the stock exchange. This guide outlines the steps to apply for an IPO, focusing on the online application process, eligibility criteria, and key considerations for a seamless experience.

Applying for an IPO can be done through offline or online methods. The online method is more convenient, as it leverages your existing trading or demat account to streamline the process. Below are the detailed steps to apply for an IPO online, inspired by the process outlined by AG Shares:

Login to Your Agssl Platform

Access the Agssl website. Navigate to the homepage and locate the ‘IPO’ section. Ensure you have an active demat account linked to Agssl.

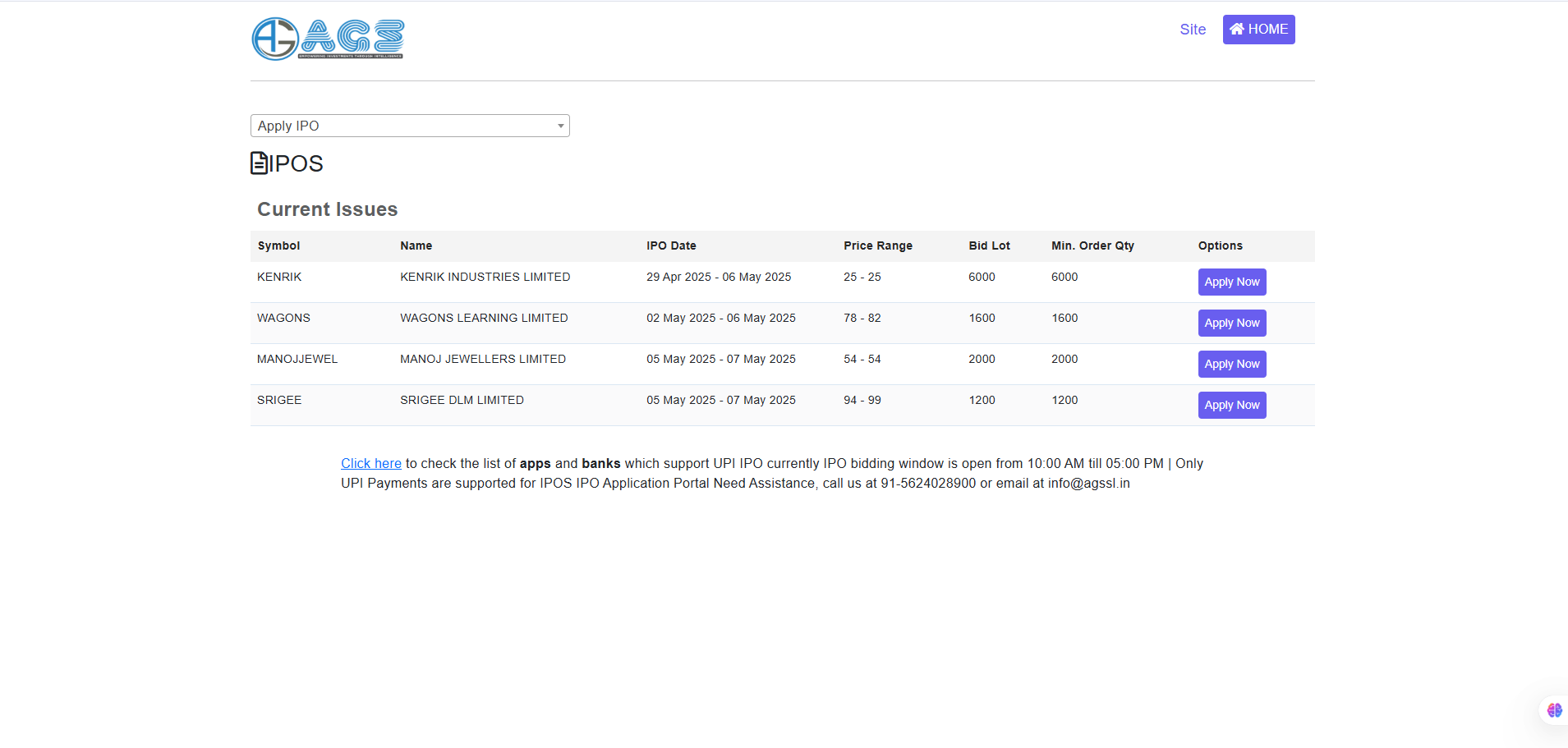

Select the Desired IPO

Browse the list of active IPOs and select the one you wish to apply for. Review critical details such as the maximum quantity, price range, company background, and subscription period.

Enter Application Details

Click on ‘Apply Now’ or a similar button to start the application. Provide the following details:

Number of Lots: Specify the number of share lots you want to bid for (a lot is a fixed number of shares defined by the IPO).

Bidding Price: For book-built IPOs, enter a price within the indicated price band. For fixed-price IPOs, use the predetermined price.

UPI ID: Link your UPI ID for payment processing under the ASBA (Applications Supported by Blocked Amount) facility.

Confirm and Submit the Application

Review your bid details and submit the application. A payment mandate will be sent to your UPI app. Accept this mandate to block the required funds in your bank account. The funds remain blocked until the allotment is finalized.

Track Application Status

After submission, monitor the status of your IPO application in the ‘Order Book’ or ‘IPO Application Status’ section of the Agssl platform. You’ll be notified about the allotment outcome.

Allotment and Demat Credit

If allotted, the shares are credited to your demat account within 10-12 days for book-built IPOs. The blocked amount in your bank account is debited only for the allotted shares, and any remaining blocked funds are released.

Trading the Shares

Once the IPO is listed on the stock exchange, you can sell the allotted shares using a trading account. If you don’t have a trading account, you’ll need one to trade the shares post-listing.

To apply for an IPO, you must meet the following requirements:

Legal Competency: Be an adult capable of entering a legal contract.

PAN Card: Hold a valid Permanent Account Number (PAN) issued by the Income Tax Department.

Demat Account: Have an active demat account to hold the allotted shares. A trading account is optional for applying but necessary for selling shares post-listing.

Retail investors (investing up to ₹2 lakh) benefit from a higher chance of allotment due to SEBI’s allocation rules favoring retail categories.

Before applying, familiarize yourself with the types of IPOs and related terms:

Types of IPOs:

Fixed Price IPO: The share price is set in advance, and investors apply at that price.

Book Built IPO: A price range is provided, and the final price is determined through a book-building process based on investor bids.

Offer Types:

New Offer: A company raises funds and lists on the stock exchange for the first time.

Follow-on Public Offer (FPO): An already listed company issues additional shares to raise more funds.

Offer-For-Sale (OFS): Existing shareholders, such as promoters, sell their shares without increasing the company’s share capital.

ASBA Facility: SEBI’s ASBA system ensures that funds are blocked in your bank account rather than debited upfront. Only the amount for allotted shares is debited, making the process efficient.

Retail Investor Advantage: Applying under the retail category (up to ₹2 lakh) increases your chances of allotment due to SEBI’s equitable distribution rules.

Due Diligence: Research the company’s financials, business model, and market potential. Evaluate risks and growth prospects before investing.

UPI Integration: Ensure your UPI ID is active and linked to a bank account with sufficient funds to cover the application amount.

Applying online through platforms like Agssl is efficient because:

Your demat account details are auto-populated, reducing manual errors.

The process is faster and can be completed from anywhere.

Real-time tracking of application status is available.

Applying for an IPO is a straightforward process if you have a demat account and access to the Agssl platform. By following the steps outlined above, you can participate in exciting investment opportunities with ease. Always conduct thorough research on the company and its IPO terms to make informed decisions. Start your investment journey today by opening a demat account with Agssl and exploring upcoming IPOs.