Introduction to the Indian Stock Market

The Indian stock market is one of the most dynamic and fastest-growing financial markets in the world. It serves as a crucial platform for companies to raise capital and for investors to generate wealth. Over the years, the market has evolved with improved regulations, technology, and financial products, making it more accessible to retail investors. This introduction provides a detailed overview of the Indian stock market, its key components, working mechanisms, and investment potential.

1. Understanding the Indian Stock Market

The stock market is a marketplace where securities (stocks, bonds, derivatives, etc.) are bought and sold. It acts as an intermediary between companies seeking funds for expansion and investors looking for profitable investment opportunities. Investors can buy shares of publicly traded companies, which represent ownership in the company, allowing them to benefit from price appreciation and dividends.

The Indian stock market operates through two major exchanges:

A. Major Stock Exchanges in India

Both exchanges function under the supervision of SEBI (Securities and Exchange Board of India).

2. Regulatory Framework

The Securities and Exchange Board of India (SEBI) is the regulatory authority that ensures the fair and transparent functioning of the stock market. SEBI’s primary responsibilities include:

SEBI plays a crucial role in maintaining market integrity, ensuring that all participants—retail investors, institutional investors, and foreign investors—can trade in a fair environment.

3. Market Segments

The Indian stock market is divided into two primary segments:

A. Primary Market (IPO Market)

The primary market is where companies raise capital by issuing shares to the public through an Initial Public Offering (IPO). Investors can subscribe to these shares before they get listed on the stock exchange. Once the shares are listed, they can be freely traded in the secondary market.

B. Secondary Market (Stock Trading)

The secondary market is where investors buy and sell shares of listed companies. Prices fluctuate based on demand, supply, company performance, economic factors, and global market trends.

The stock exchanges (NSE & BSE) facilitate transactions electronically, ensuring liquidity and transparency in the market.

4. Stock Market Indices

Stock market indices act as indicators of overall market performance.

These indices help investors analyze market trends and make informed investment decisions.

5. How the Indian Stock Market Works

The Indian stock market operates electronically, with trades executed through brokers. Here’s how it works:

Trading occurs in two major categories:

6. Why Invest in the Indian Stock Market?

Investing in the stock market offers several advantages:

✔ Wealth Creation – Stocks have historically generated higher long-term returns than traditional savings options.

✔ Beating Inflation – Stock market returns generally outperform inflation, preserving purchasing power.

✔ Liquidity – Stocks can be easily bought and sold on stock exchanges.

✔ Portfolio Diversification – Investors can spread risk across different sectors and asset classes.

✔ Participation in Economic Growth – Investing in Indian companies allows investors to benefit from the country’s economic expansion.

However, stock market investments come with risks, and investors must conduct proper research and risk assessment before investing.

7. Key Factors Influencing the Indian Stock Market

Several factors affect the performance of the stock market:

✔ Economic Indicators – GDP growth, inflation, interest rates, and fiscal policies impact stock prices.

✔ Corporate Performance – Earnings reports, dividends, and mergers influence investor sentiment.

✔ Global Markets – International economic trends, foreign investments, and geopolitical events affect Indian markets.

✔ Government Policies – Regulations, tax policies, and monetary policies set by the RBI impact market movements.

8. Challenges & Risks in Stock Market Investing

While investing in the stock market can be profitable, it is essential to understand the risks involved:

✔ Market Volatility – Stock prices fluctuate based on market conditions.

✔ Risk of Losses – Poor investment decisions can lead to capital loss.

✔ Emotional Investing – Fear and greed can lead to impulsive decisions.

✔ Lack of Knowledge – Not understanding market trends can lead to poor investment choices.

Investors should adopt a long-term perspective, diversify investments, and stay informed to mitigate risks.

9. Conclusion

The Indian stock market is a vital financial hub, providing a platform for businesses to raise capital and for investors to grow their wealth. With proper knowledge, risk management, and long-term strategies, stock market investments can yield high returns.

As India continues to expand its economy, the stock market remains a lucrative opportunity for investors. Whether you are a beginner or an experienced trader, understanding market fundamentals is the key to making informed and profitable investment decisions.

Introduction In the dynamic world of stock trading, developing a well-researched point of view is critical for success. Whether you're a seasoned trader or a beginner, Technical Analysis (TA) serves as an invaluable tool in identifying market trends and making informed trading decisions. This blog explores the fundamentals of TA, its assumptions, and practical applications to help you navigate the stock markets efficiently.

What is Technical Analysis? Technical Analysis is a method used to evaluate securities by analyzing price movements and trading volumes. Unlike Fundamental Analysis, which focuses on a company's financials, TA relies on historical price patterns to predict future price movements. It helps traders determine key aspects of a trade, such as:

The ideal entry and exit points

The level of risk involved

The expected reward

The duration for holding a position

Technical Analysis is based on the belief that historical price movements tend to repeat themselves, allowing traders to identify trends and patterns that can be leveraged for profitable trades.

Key Assumptions of Technical Analysis TA operates on several fundamental assumptions:

Market Discounts Everything: All available information, including past price movements and external factors, is already reflected in the stock’s price.

Price Moves in Trends: Once a trend is established, prices are likely to continue moving in that direction until a reversal occurs.

History Tends to Repeat Itself: Market participants often react in similar ways to comparable market situations, creating recognizable price patterns.

Chart Types in Technical Analysis To effectively analyze stock trends, traders use various charting techniques. Some of the most popular types include:

Line Chart: Provides a basic overview of closing prices over a specific time frame.

Bar Chart: Displays open, high, low, and close (OHLC) prices, offering more detailed insights.

Japanese Candlestick Chart: The most widely used chart, providing visual representation of market sentiment and trend direction.

Popular Candlestick Patterns Candlestick patterns play a crucial role in identifying trading opportunities. Here are some key patterns every trader should know:

Marubozu: A candlestick with no upper or lower shadow, indicating strong buying (bullish Marubozu) or selling (bearish Marubozu) pressure.

Doji: A candle where the open and close prices are nearly equal, signaling indecision in the market.

Hammer: A bullish reversal pattern that appears at the bottom of a downtrend.

Shooting Star: A bearish reversal pattern appearing at the top of an uptrend.

How to Use Technical Analysis Effectively? TA is best suited for identifying short-term trading opportunities rather than long-term investments. Here are a few best practices for traders:

Use Multiple Indicators: Relying on a single pattern or indicator can be misleading. Combine different tools like Moving Averages, RSI, and MACD for better accuracy.

Manage Risks Wisely: Always set stop-loss orders to limit potential losses.

Understand Market Sentiment: Recognizing bullish and bearish trends helps in making better trading decisions.

Choose the Right Time Frame: Traders should select time frames that match their trading style, whether it's intraday, short-term, or long-term analysis.

Conclusion Technical Analysis is a powerful approach to trading that helps traders make informed decisions based on historical price data. By understanding patterns, trends, and key indicators, traders can enhance their ability to predict market movements and optimize their trading strategies. While TA does not guarantee success, when combined with proper risk management and discipline, it can significantly improve trading performance.

Stay tuned for more insights from AGSSL, your trusted partner in the stock market journey!

Introduction to Fundamental Analysis

Overview: Fundamental Analysis (FA) is a method used to assess a company’s financial health and long-term growth potential. It involves analyzing financial statements, management quality, industry trends, and macroeconomic factors. Unlike Technical Analysis, which focuses on stock price movements, FA helps investors make informed decisions based on a company's actual performance.

Key Concepts:

Types of Fundamental Analysis:

Becoming a Fundamental Analyst: Anyone with basic financial knowledge and a structured approach can analyze stocks using FA.

Essential Tools for FA:

Mindset of an Investor

Investor vs Trader vs Speculator:

Power of Compounding:

Core-Satellite Investment Strategy:

How to Read an Annual Report

Key Sections in an Annual Report:

Standalone vs Consolidated Financial Reports:

Understanding Corporate Governance:

Understanding Financial Statements

Profit & Loss (P&L) Statement

A report summarizing a company’s financial performance over a given period.

Key Components:

Balance Sheet

A snapshot of a company’s financial position at a specific time.

Key Elements:

Cash Flow Statement

Tracks how cash is generated and used by the company.

Main Sections:

Key Financial Ratios for Analysis:

Investment Decision-Making Using FA

Steps to Analyze a Stock Using Fundamental Analysis:

Common Mistakes to Avoid in FA:

Key Takeaways:

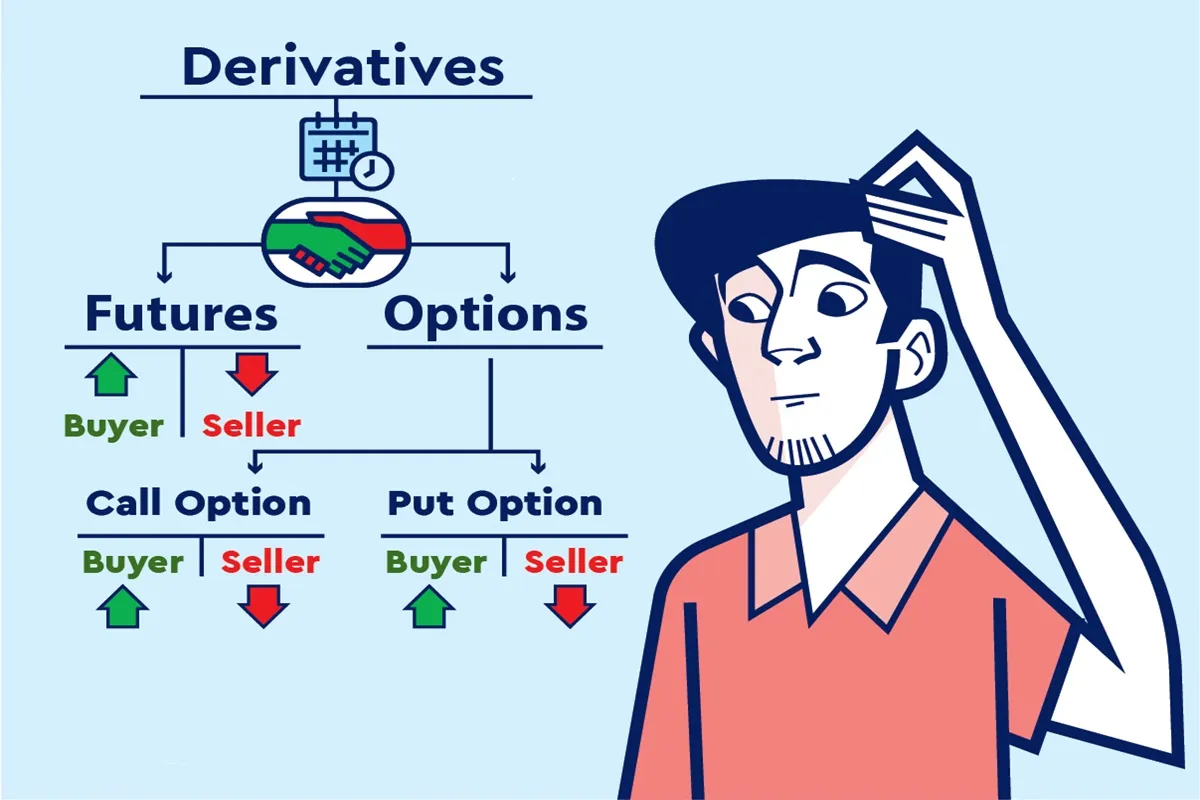

Understanding Futures Trading: A Comprehensive Guide

Futures trading is a fundamental part of financial markets, allowing traders to speculate on the future price movements of various assets. Whether you're an experienced investor or a beginner looking to explore this field, understanding the key concepts of futures trading is essential. This blog provides a detailed breakdown of futures trading, explaining its mechanics, key features, types of contracts, advantages, risks, and strategies.

1. What is Futures Trading?

Futures trading involves buying and selling contracts that commit the trader to buy or sell an underlying asset at a predetermined price on a specified future date. These contracts are standardized and traded on regulated exchanges, making them highly liquid and accessible.

Futures contracts are used for both hedging (risk management) and speculation (profit generation). Traders and investors use futures to protect their portfolios from adverse price movements or to gain from price fluctuations in stocks, indices, commodities, currencies, and interest rates.

2. How Does Futures Trading Work?

Futures trading is based on a contractual agreement between two parties:

Each contract has a specific lot size, expiration date, and settlement process. Since futures contracts are traded on an exchange, they require a margin deposit, which acts as collateral and helps maintain financial security.

Example: If an investor buys a futures contract for gold at ₹1,50,000 per 10 grams and the price rises to ₹1,55,000, they make a profit of ₹5,000 per contract. Conversely, if the price drops to ₹1,45,000, they incur a loss of ₹5,000 per contract.

3. Key Features of Futures Contracts

4. Types of Futures Contracts

Futures contracts cover various asset classes, including:

Each type of futures contract has unique factors influencing its price, such as supply and demand, economic data, and geopolitical events.

5. Benefits of Futures Trading

A. Hedging Against Market Risk

Hedging with futures helps businesses and investors reduce risks associated with price fluctuations. For example, a farmer selling wheat futures at ₹2,500 per quintal can lock in the price, ensuring stability even if market prices drop.

B. High Leverage

Futures trading requires only a margin deposit, allowing traders to control larger positions than their capital would otherwise permit.

C. Market Liquidity

Since futures contracts are actively traded on exchanges, they provide ample liquidity, enabling easy entry and exit of positions.

D. Portfolio Diversification

Investors can diversify their portfolios by trading different types of futures contracts, thereby spreading risk across multiple asset classes.

E. Price Discovery

Futures markets help determine fair prices for underlying assets based on supply, demand, and global economic conditions.

6. Risks of Futures Trading

A. Leverage Risk

While leverage can amplify profits, it can also lead to significant losses if the market moves against a trader’s position.

B. Price Volatility

Futures markets are highly volatile, and price swings can result in substantial losses if not managed properly.

C. Margin Calls

If a trade moves against a trader’s position, they may receive a margin call requiring additional funds to maintain their position.

D. Expiration Risk

Futures contracts have fixed expiry dates, and traders must either roll over their contracts or settle them before expiration.

E. Liquidity Risk

Some contracts may have lower liquidity, making it harder to exit positions quickly without significant price slippage.

7. Trading Strategies in Futures Markets

A. Trend Following

Traders use technical indicators like moving averages to identify trends and trade in the direction of the market.

B. Spread Trading

This strategy involves buying and selling related futures contracts to profit from price differences.

C. Arbitrage

Traders exploit price differences between futures and spot markets for risk-free profits.

D. Hedging

Institutions and investors use futures to protect against adverse price movements in their portfolios.

E. Scalping

A short-term strategy where traders take advantage of small price movements for quick profits.

F. Swing Trading

Traders hold positions for several days to capitalize on short-term market fluctuations.

8. Regulatory Framework for Futures Trading

Futures trading is governed by strict regulations to ensure transparency and protect investors. Regulatory bodies such as the Securities and Exchange Board of India (SEBI) oversee futures trading in India, while the Commodity Futures Trading Commission (CFTC) regulates futures markets in the U.S.

Regulations include:

9. How to Start Trading Futures?

Step 1: Choose a Reputable Broker

Selecting a SEBI-registered broker with competitive fees and good trading platforms is essential.

Step 2: Open a Trading Account

Traders need to open a futures trading account with a broker and deposit the required margin.

Step 3: Learn Market Fundamentals

Understanding market trends, economic indicators, and technical analysis helps traders make informed decisions.

Step 4: Develop a Trading Plan

A well-defined strategy, including entry and exit points, risk management, and stop-loss orders, is crucial for success.

Step 5: Start with Paper Trading

New traders should practice with a demo account before investing real money.

10. Conclusion

Futures trading is a powerful financial tool used by traders, investors, and businesses for hedging and speculation. While it offers significant opportunities for profit, it also carries inherent risks that require careful management.

To succeed in futures trading, traders should develop a sound strategy, manage risk effectively, and stay updated with market trends. If you are new to futures trading, consider starting with small positions and using risk management techniques to protect your capital.

Options Theory for Professional Trading (Indian Market Edition) 🇮🇳

The Indian stock market offers a variety of options trading opportunities, mainly on NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). This guide will break down options trading in India, including how it works, key strategies, and practical examples based on Indian stocks and indices like Nifty 50, Bank Nifty, and stocks like Reliance, TCS, HDFC Bank, etc.

What Are Options in the Indian Market?

Options are derivative contracts that give traders the right, but not the obligation, to buy (Call Option) or sell (Put Option) an asset at a fixed price before the expiry date.

In India, options trading is mainly done on the NSE through F&O (Futures & Options) contracts. The most traded options are:

NIFTY 50 options – Based on the Nifty index

BANK NIFTY options – Based on the Bank Nifty index

Stock options – Available for selected stocks like Reliance, Infosys, HDFC Bank, etc.

Options are used by traders to:

Types of Options in India

Call Option (CE) – The Right to Buy

A Call Option gives you the right to buy an asset at a fixed price.

Example:

Put Option (PE) – The Right to Sell

A Put Option gives you the right to sell an asset at a fixed price.

Example:

Summary:

Important Terms in Options Trading (Indian Market)

Strike Price → The price at which the option can be exercised (e.g., Nifty 22,100 CE).

Premium → The cost of buying an option (changes based on market demand).

Expiry Date → Options expire on the last Thursday of every month (weekly expiries for indices).

Lot Size → You cannot buy 1 option; you must buy in "lots" (e.g., Nifty50 lot = 50 units).

Intrinsic Value → The real value of an option if exercised immediately.

Time Decay (Theta) → Options lose value as expiry nears (affects buyers).

How Traders Use Options in India

Speculators: Traders bet on short-term price movements in stocks or indices.

Hedgers: Investors use options to protect against market losses.

Income Seekers: Selling options generates premium income.

Popular Option Trading Strategies (Indian Market Examples) 🇮🇳

Covered Call (For Extra Income)

Best for: Investors who already own stocks and want to make extra income.

How it works: Sell a Call Option on a stock you own and earn a premium.

Example (HDFC Bank Covered Call)

Protective Put (For Risk Management)

Best for: Protecting stock holdings from a sudden crash.

How it works: Buy a Put Option to hedge against downside risk.

Example (Reliance Protective Put)

Straddle (For Big Movements in Any Direction)

Best for: Trading events like Budget Announcements, RBI Meetings, or Quarterly Results.

How it works: Buy a Call and Put at the same strike price.

Example (Nifty Straddle on RBI Policy Day)

Iron Condor (For Sideways Markets)

Best for: When you think Nifty or Bank Nifty will trade in a range.

How it works: Sell a Call and Put to collect premiums.

Example (Bank Nifty Iron Condor)

What Affects Option Prices in India? (The “Greeks”)

Delta → Measures how much the option price moves when the stock/index price moves.

Theta (Time Decay) → Options lose value as expiry nears (affects option buyers).

Vega → Options prices increase when volatility rises (e.g., before major news events).

Gamma → Measures how fast Delta changes.

Example:

Final Thoughts: Should You Trade Options in India?

Advantages:

Small capital required (compared to stocks).

Can make money in any market direction (up, down, or sideways).

Used by professionals for hedging risks and boosting returns.

Risks:

Options expire worthless if they don’t move in your Favor.

Time decay reduces option prices quickly near expiry.

Selling options carries unlimited risk if not managed properly.

Pro Tips for Indian Traders

Always check liquidity (avoid low-volume stocks).

Be aware of event-based volatility (RBI meetings, elections, budgets).

Manage risk using stop-losses & hedging strategies.

Understanding Currency and Commodity Futures: A Comprehensive Guide

In today's dynamic global economy, understanding financial instruments that help manage risk is crucial for individuals, businesses, and institutions alike. Among these tools, currency futures and commodity futures stand out for their ability to provide hedging, speculative, and arbitrage opportunities. This guide explores what these instruments are, how they work, and why they are vital in the Indian financial landscape.

________________________________________

What Are Currency Futures?

Currency futures are standardized exchange-traded contracts that obligate the buyer to purchase, and the seller to sell, a specific amount of a currency at a predetermined price on a specified future date. These are traded on recognized exchanges like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) in India, and globally on platforms like the Chicago Mercantile Exchange (CME).

Key Features of Currency Futures:

• Standardization: Contract size, maturity date, and tick size are standardized.

• Exchange-Traded: Ensures transparency and reduces counterparty risk.

• Mark-to-Market: Daily settlement of profits and losses ensures real-time accountability.

• Leverage: Traders can control a large position with a relatively small amount of capital.

Example Use Case:

Imagine an Indian importer who is required to pay $100,000 to a U.S. supplier three months from now. If the rupee depreciates against the dollar during this period, the importer will end up paying more in INR. To hedge against this risk, the importer can buy USD-INR futures, locking in the exchange rate.

________________________________________

What Are Commodity Futures?

Commodity futures are contracts to buy or sell a specific quantity of a commodity like gold, crude oil, wheat, or cotton at a future date and price. These are traded on commodity exchanges such as MCX (Multi Commodity Exchange) and NCDEX (National Commodity and Derivatives Exchange) in India.

Key Features of Commodity Futures:

• Physical or Cash Settlement: Depending on the contract, delivery can be physical or settled in cash.

• Hedging Tool: Protects against price volatility in commodities.

• Speculation and Arbitrage: Enables profit from price fluctuations and discrepancies between markets.

• SEBI Regulation: All contracts and participants are governed by the Securities and Exchange Board of India.

Example Use Case:

A cotton farmer anticipates harvesting 10 tons of cotton in the next six months. Concerned about falling prices, the farmer can sell cotton futures today, thus locking in the current favourable price. When harvest time arrives, even if prices fall, the farmer receives the pre-agreed rate.

________________________________________

Purpose and Benefits of Futures Contracts

Whether it’s currency or commodity, futures contracts are used for:

1. Hedging: Protects businesses and investors from adverse price movements.

2. Speculation: Allows traders to profit from expected future price changes.

3. Arbitrage: Takes advantage of price differences across markets.

Who Uses Futures?

• Importers and Exporters: Hedge against exchange rate volatility.

• Farmers and Producers: Secure prices for their goods.

• Investors and Traders: Speculate on price movements.

• Corporates and Institutions: Manage cash flows and financial planning.

________________________________________

Currency Futures vs Commodity Futures: A Comparison

Feature Currency Futures Commodity Futures

Underlying Asset Currencies (USD, EUR, INR) Physical Commodities (Gold, Oil, Wheat)

Purpose Manage forex exposure Manage commodity price risks

Major Users Exporters, Importers, MNCs, Banks Farmers, Traders, Industrial Buyers

Indian Exchanges NSE, BSE MCX, NCDEX

Risk Level Medium Medium to High

Settlement Cash-Settled Cash or Physical

________________________________________

🇮🇳 Futures Trading in the Indian Context

India has seen a steady rise in participation in futures trading. Platforms like MCX for commodities and NSE for currency derivatives offer robust infrastructure and regulatory oversight.

The Securities and Exchange Board of India (SEBI) ensures fair practices, transparency, and investor protection in the derivatives market.

In recent years, Indian investors have shown greater interest in using futures as part of their investment strategies—not just for hedging, but also for diversification and enhanced returns.

________________________________________

Educational Initiatives and Market Awareness

Recognizing the need for informed investors, Indian exchanges and brokers regularly conduct:

• Investor Awareness Programs

• Webinars and Workshops

• Online Simulation Platforms for practice trading

These programs help young traders and retail investors understand the mechanics and risks of futures contracts.

________________________________________

Key Takeaways

• Futures contracts are vital tools for managing financial risk.

• Currency futures protect against foreign exchange volatility.

• Commodity futures help producers and consumers lock in prices.

• Indian exchanges offer transparent, regulated platforms for trading.

• Education and expert guidance are crucial for new investors.

________________________________________

Conclusion

Currency and commodity futures are no longer instruments reserved for large institutions—they are accessible, useful, and increasingly essential for individual investors and small businesses in India. Whether you're an importer hedging currency risk or a farmer securing your product's price, futures offer a way to reduce uncertainty and plan confidently.

As India's financial markets evolve, understanding and leveraging futures trading can offer a significant advantage to proactive investors.

Stay tuned for more deep dives into financial tools and strategies to secure your future in the global economy!

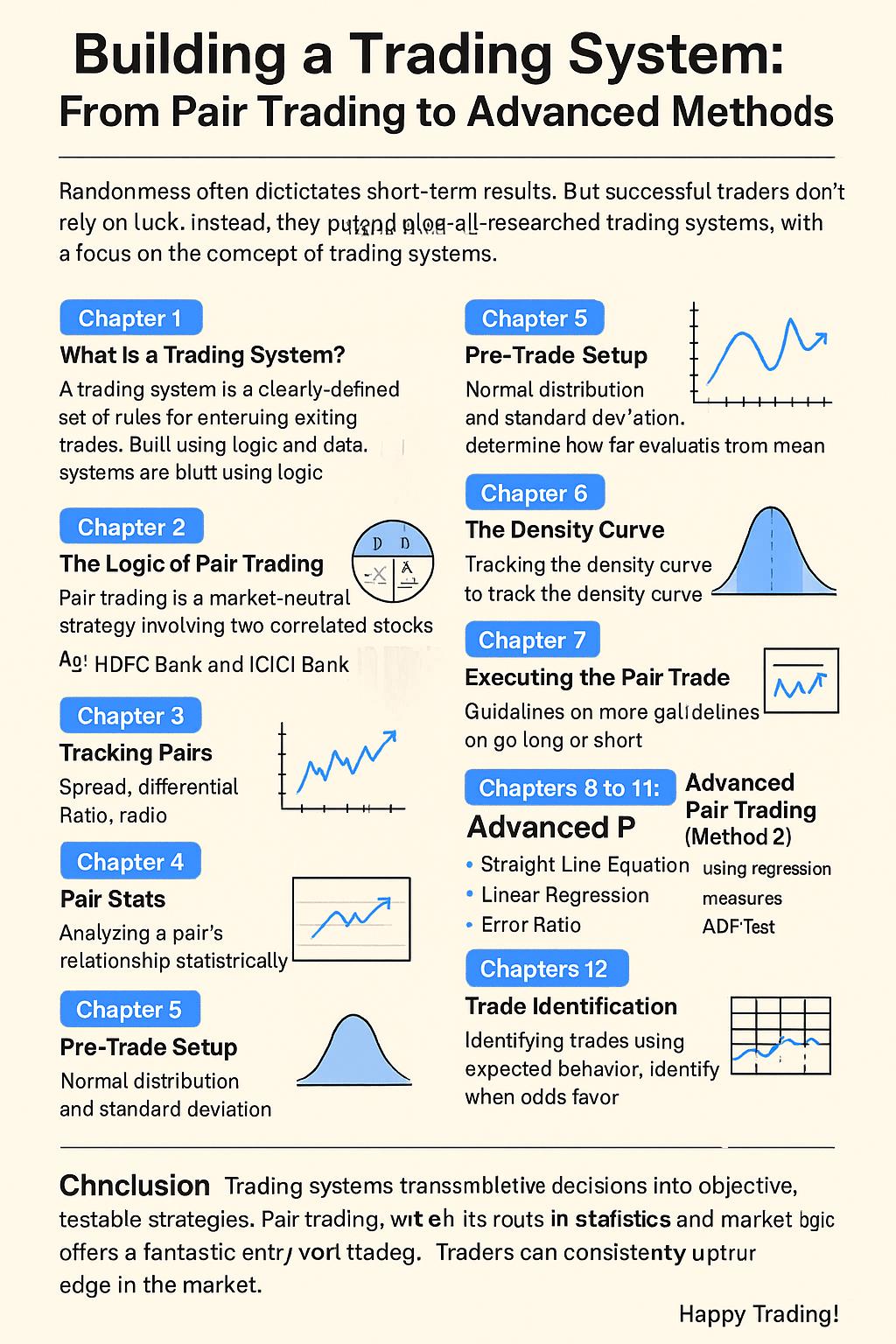

In the world of trading, randomness often dictates short-term results. But successful traders don’t rely on luck. Instead, they build well-researched trading systems that are objective, repeatable, and measurable. In this blog, we explore the concept of trading systems, with a focus on the popular "Pair Trading" strategy, and cover advanced methods including statistical tools and real-world case studies. Let’s get started on the path to structured trading success.

A trading system is a clearly defined set of rules for entering and exiting trades. Unlike emotional or speculative trading, systems are built using logic and data. Think of it as creating a machine that makes decisions based on predefined inputs. Systems help eliminate emotional errors, enforce discipline, and allow backtesting to assess their effectiveness before deploying real capital.

Trading systems are not magic bullets. They require monitoring, tweaking, and strict adherence. But once developed, they can turn trading into a scalable and consistent practice.

Pair trading is a market-neutral strategy involving two correlated stocks. The basic idea is simple: when two historically correlated stocks temporarily diverge in price, we short the outperformer and long the underperformer, expecting the relationship to revert.

Imagine HDFC Bank and ICICI Bank. They operate in similar environments, cater to similar customers, and often move together. If one suddenly shoots up while the other remains flat, a trader might short the one that surged and buy the one that lagged, assuming the gap will close.

This strategy thrives on the concept of mean reversion and is relatively immune to broader market direction.

To identify viable trading pairs, we need tools:

Spread: Difference in daily returns of two stocks

Differential: Difference in absolute stock prices

Ratio: Price of stock A divided by price of stock B

By tracking these metrics over time, we observe patterns and anomalies. For example, a widening spread may indicate a trading opportunity.

Another vital concept is correlation, which measures how closely two stocks move together. A correlation close to +1 indicates strong positive relation, essential for successful pair trading.

Once we have a pair, we analyze its relationship statistically. We use Excel to calculate:

Daily returns

Correlation (based on prices or returns)

Spread, differential, and ratio

We also calculate basic statistics like mean, median, and mode to understand the central tendencies of these variables.

This chapter introduces normal distribution and standard deviation, which help determine how far a stock's behavior is from its average.

We set up a standard deviation table for spread, differential, and ratio. When a value falls 2 or 3 standard deviations away from the mean, it could signal a high-probability trade.

A key refinement is tracking the density curve, which gives the probability of the variable reverting to the mean.

For example:

If the density value is 0.975, the ratio is far from the mean and has a high chance of mean reversion.

This helps traders stay disciplined and avoid false signals. Tools like Excel's NORM.DIST function make it easy to implement.

With all variables aligned, it’s time to trade. General guidelines:

Go long the ratio when density is between 0.003 and 0.025

Go short when density is between 0.975 and 0.997

Monitor the ratio daily, and exit as it reverts toward the mean. Use standard deviation zones as stop-loss and take-profit levels.

These chapters introduce a more statistical approach:

Straight Line Equation using regression

Linear Regression to model expected price

Error Ratio to measure deviation

ADF Test to ensure the relationship is stationary

These methods improve reliability by grounding decisions in mathematics.

Combining the previous methods, we can now identify trades with high confidence. This involves calculating expected behavior, identifying divergence, and acting when the odds favor reversion.

Chapter 13 & 14: Live Trade Examples

Real examples show how these techniques work in the market. Each trade highlights entry, rationale, risk control, and outcome. These are powerful learning tools for traders.

A new strategy that involves buying and selling futures contracts of the same stock with different expiry dates. It benefits from time decay and volatility changes.

Chapter 16: Momentum Portfolios

Here, traders build a portfolio of high-momentum stocks, aiming to ride the trend. Selection is based on performance metrics and relative strength.

Conclusion

Trading systems transform subjective decisions into objective, testable strategies. Pair trading, with its roots in statistics and market logic, offers a fantastic entry point. By combining discipline, data, and sound risk management, traders can consistently capture edge in the market.

Happy Trading!

A Beginner's Guide to Intraday Trading: Tips, Strategies, and Essentials

Introduction

Intraday trading, also known as day trading, involves buying and selling stocks within the same trading day to profit from price fluctuations. It’s a fast-paced, high-risk, high-reward approach that appeals to those seeking quick gains. Success requires knowledge, discipline, and a solid strategy. This guide, inspired by insights from AGSSL, breaks down the essentials of intraday trading for beginners, offering practical tips to help you navigate the stock market confidently. Visit AGSSL for tools and resources to get started.

What is Intraday Trading?

Intraday trading refers to purchasing and selling stocks during a single day’s trading hours, typically between 9:15 AM and 3:15 PM in India. The goal is to profit from small price movements by closing all positions before the market shuts, avoiding overnight risks. Unlike long-term investing, intraday trading leverages volatility for immediate returns but demands quick decision-making and risk management.

Key Features of Intraday Trading:

Why Choose Intraday Trading?

Intraday trading offers unique advantages that attract both new and seasoned traders:

However, the high risk of losses and constant market monitoring make it unsuitable for everyone. Beginners must approach intraday trading with caution and preparation.

Getting Started: Steps for Beginners

To embark on your intraday trading journey, follow these foundational steps:

How to Choose Stocks for Intraday Trading

Selecting the right stocks is critical for intraday success. Here are key tips to guide your selection:

Top Intraday Trading Strategies

Effective strategies help beginners maximize returns while managing risks. Here are five proven approaches:

Essential Intraday Trading Tips

To succeed in intraday trading, adopt these best practices:

Common Mistakes to Avoid

Beginners often fall into traps that lead to losses. Here’s what to watch out for:

Tools and Indicators for Intraday Trading

To enhance your trading decisions, use these tools and indicators:

Risk Management in Intraday Trading

Effective risk management is the backbone of successful intraday trading. Follow these principles:

Conclusion

Intraday trading offers exciting opportunities for quick profits but comes with significant risks. By educating yourself, choosing liquid stocks, adopting proven strategies, and practicing strict risk management, you can increase your chances of success. Platforms like AGSSL provide valuable tools, real-time data, and educational resources to support beginners. Start small, practice with a demo account, and stay disciplined to build your skills over time.

Ready to dive into intraday trading? Open a free Demat and trading account with AGSSL to access their user-friendly platform and expert guidance. Visit AGSSL to get started today!

Call to Action

An Initial Public Offering (IPO) is a pivotal moment for a company, marking its transition from private to public by offering shares to the public for the first time. This process allows businesses to raise capital and provides investors an opportunity to own a stake in promising companies. In this blog, we’ll explore what an IPO is, how it works, and key considerations for investors, with insights tailored for the Indian market.

An IPO is the process through which a privately held company becomes publicly traded by issuing shares on a stock exchange. It enables the company to raise funds for growth, debt repayment, or other strategic goals while offering investors a chance to participate in its future success. Once listed, shares are traded in the secondary market, providing liquidity to shareholders.

Companies launch IPOs for several reasons:

Raising Capital: Funds support business expansion, infrastructure upgrades, or debt reduction.

Liquidity for Shareholders: Early investors and founders can sell their stakes, as private shares have limited liquidity.

Enhanced Visibility: Public listing boosts brand credibility, attracting talent and partnerships.

Market Access: Public companies can issue additional shares for mergers, acquisitions, or further growth.

The IPO process in India is regulated by the Securities and Exchange Board of India (SEBI) and involves the following steps:

Preparation: The company works with investment banks, auditors, and legal teams to prepare financial statements and a prospectus detailing operations, risks, and financial health.

Underwriter Selection: An investment bank is hired to underwrite the IPO, setting the share price and facilitating share sales to investors.

Regulatory Approval: The company files a registration statement with SEBI, which reviews it for compliance.

Pricing and Valuation: The share price is determined based on company fundamentals, market demand, and underwriter analysis.

Roadshow and Marketing: The company promotes the IPO to institutional and retail investors through presentations and campaigns.

Share Allotment: Shares are allocated to applicants, often via a lottery system if the IPO is oversubscribed.

Listing: Shares are listed on a stock exchange (e.g., BSE or NSE), and trading begins.

IPOs in India are categorized into two types:

Fixed Price Issue: The share price is set in advance and disclosed in the offer document. Demand is known only after the issue closes, often leading to high oversubscription.

Book Building Issue: A price band (floor and cap prices) is set, and the final price is determined by investor bids, offering flexibility and efficiency.

IPO valuation depends on:

Company Fundamentals: Assets, liabilities, revenue, and growth prospects are analyzed.

Market Conditions: Supply and demand influence pricing.

Underwriter Assessment: Investment banks evaluate the company to set a fair price.

Investors should review the prospectus to assess whether the IPO is underpriced (potential for gains) or overpriced (limited returns post-listing). Valuation ratios like P/E, P/B, and debt-to-equity provide deeper insights.

SEBI mandates IPO grading by a registered Credit Rating Agency (CRA) to evaluate a company’s fundamentals. Grades range from 1 (weak) to 5 (strong) and assess factors like business prospects, management quality, and governance. While a higher grade suggests better potential, investors should still conduct independent research, as grading isn’t a guarantee of success.

Any adult with a PAN card and a valid demat account can apply for an IPO. A trading account is required to sell shares post-listing. Here’s how to apply:

Online Application:

Use Agssl’s app or website.

Enter details like lot size, bidding price, and UPI ID.

Approve the payment mandate via a UPI app.

Offline Application:

Submit a physical form to the IPO banker or broker.

Alternatively, use the ASBA (Application Supported by Blocked Amount) process through a bank.

UPI-Based Application: Funds are blocked in your bank account until allotment, then debited or released based on allocation.

Cut-Off Price: Bidding at the final issue price increases allotment chances, especially for retail investors.

In oversubscribed IPOs, shares are allotted via a lottery system, with retail investors guaranteed at least one lot per SEBI rules. Common reasons for non-allotment include:

Multiple applications with the same PAN.

Mismatched UPI, bank, or demat details.

Bidding below the final issue price.

Check allotment status on the Agssl app or the registrar’s website (e.g., Kfin Technologies). Shares are credited to the demat account, and trading begins on the listing date, typically at 10:00 AM.

Investors can sell shares on the listing day or later, depending on their goals. Key considerations include:

Listing Day Gains: Prices often rise initially due to demand, offering quick profits.

Long-Term Holding: Suitable for companies with strong growth potential.

Tax Implications: Short-term capital gains tax applies if sold within a year.

Lock-Up Periods: Some IPOs restrict selling to prevent share dumping.

Issue Size: ₹24.71 crore (31.28 lakh shares).

Price Band: ₹75–₹79 per share.

Dates: March 28, 2025–April 3, 2025.

Listing: BSE SME, April 8, 2025.

Minimum Investment: ₹1,20,000 (1,600 shares) for retail investors.

Purpose: Develop new courses, enhance LMS features, and purchase equipment.

Dates: July 24, 2024–July 26, 2024.

Listing: July 31, 2024.

Focus: K-12 educational publishing with digital content via QR codes.

Minimum Lot: 1,600 shares.

Research Thoroughly: Study the prospectus for company details, risks, and financials. Check IPO grading and credit ratings (e.g., CRISIL, CARE).

Analyze Fundamentals: Evaluate valuation ratios and growth prospects. Avoid IPOs focused solely on debt repayment.

Maximize Allotment Chances:

Apply for one lot in oversubscribed IPOs.

Bid at the cut-off price.

Use multiple demat accounts (with different PANs) for family members.

Submit applications early to avoid technical issues.

Understand Risks: IPOs lack trading history, making them riskier. Diversify investments and align with your financial goals.

Market Volatility: Post-listing price fluctuations are common.

Oversubscription: Reduces allotment chances for retail investors.

Limited Data: Unlike established stocks, IPOs lack historical trading performance.

Purpose of Funds: IPOs focused on debt repayment or working capital may offer lower growth potential.

IPOs offer a unique opportunity to invest in companies at an early stage, but they come with risks that require careful evaluation. By researching the company’s fundamentals, understanding the application process, and aligning investments with your goals, you can make informed decisions. Platforms like Agssl simplify IPO applications with user-friendly tools and provide resources like IPO calendars and analysis reports.

Ready to explore upcoming IPOs? Visit Agssl’s Upcoming IPOs for the latest opportunities and start your investment journey today!

An Initial Public Offering (IPO) is a significant opportunity for investors to participate in a company's growth by purchasing shares before they are listed on the stock exchange. This guide outlines the steps to apply for an IPO, focusing on the online application process, eligibility criteria, and key considerations for a seamless experience.

Applying for an IPO can be done through offline or online methods. The online method is more convenient, as it leverages your existing trading or demat account to streamline the process. Below are the detailed steps to apply for an IPO online, inspired by the process outlined by AG Shares:

Login to Your Agssl Platform

Access the Agssl website. Navigate to the homepage and locate the ‘IPO’ section. Ensure you have an active demat account linked to Agssl.

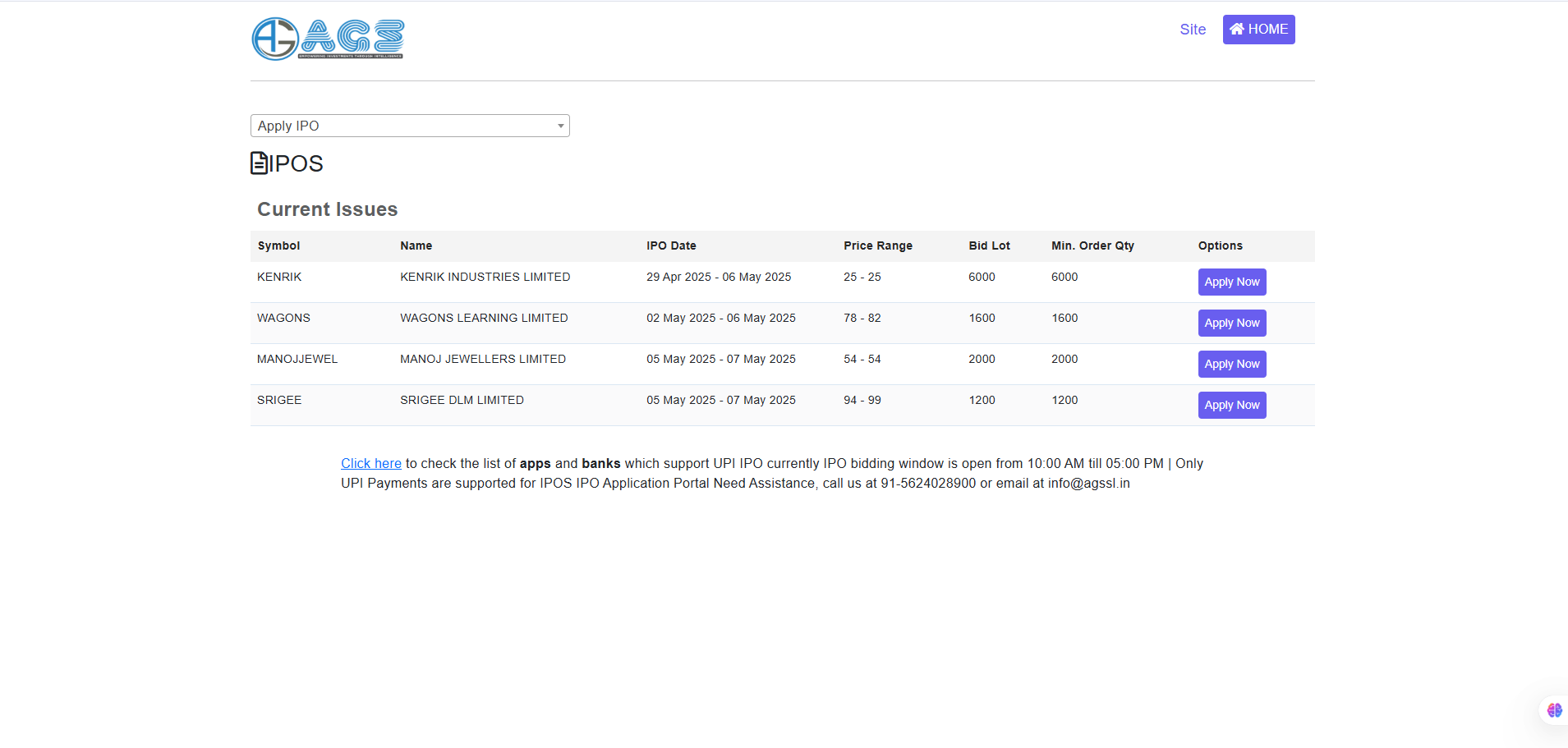

Select the Desired IPO

Browse the list of active IPOs and select the one you wish to apply for. Review critical details such as the maximum quantity, price range, company background, and subscription period.

Enter Application Details

Click on ‘Apply Now’ or a similar button to start the application. Provide the following details:

Number of Lots: Specify the number of share lots you want to bid for (a lot is a fixed number of shares defined by the IPO).

Bidding Price: For book-built IPOs, enter a price within the indicated price band. For fixed-price IPOs, use the predetermined price.

UPI ID: Link your UPI ID for payment processing under the ASBA (Applications Supported by Blocked Amount) facility.

Confirm and Submit the Application

Review your bid details and submit the application. A payment mandate will be sent to your UPI app. Accept this mandate to block the required funds in your bank account. The funds remain blocked until the allotment is finalized.

Track Application Status

After submission, monitor the status of your IPO application in the ‘Order Book’ or ‘IPO Application Status’ section of the Agssl platform. You’ll be notified about the allotment outcome.

Allotment and Demat Credit

If allotted, the shares are credited to your demat account within 10-12 days for book-built IPOs. The blocked amount in your bank account is debited only for the allotted shares, and any remaining blocked funds are released.

Trading the Shares

Once the IPO is listed on the stock exchange, you can sell the allotted shares using a trading account. If you don’t have a trading account, you’ll need one to trade the shares post-listing.

To apply for an IPO, you must meet the following requirements:

Legal Competency: Be an adult capable of entering a legal contract.

PAN Card: Hold a valid Permanent Account Number (PAN) issued by the Income Tax Department.

Demat Account: Have an active demat account to hold the allotted shares. A trading account is optional for applying but necessary for selling shares post-listing.

Retail investors (investing up to ₹2 lakh) benefit from a higher chance of allotment due to SEBI’s allocation rules favoring retail categories.

Before applying, familiarize yourself with the types of IPOs and related terms:

Types of IPOs:

Fixed Price IPO: The share price is set in advance, and investors apply at that price.

Book Built IPO: A price range is provided, and the final price is determined through a book-building process based on investor bids.

Offer Types:

New Offer: A company raises funds and lists on the stock exchange for the first time.

Follow-on Public Offer (FPO): An already listed company issues additional shares to raise more funds.

Offer-For-Sale (OFS): Existing shareholders, such as promoters, sell their shares without increasing the company’s share capital.

ASBA Facility: SEBI’s ASBA system ensures that funds are blocked in your bank account rather than debited upfront. Only the amount for allotted shares is debited, making the process efficient.

Retail Investor Advantage: Applying under the retail category (up to ₹2 lakh) increases your chances of allotment due to SEBI’s equitable distribution rules.

Due Diligence: Research the company’s financials, business model, and market potential. Evaluate risks and growth prospects before investing.

UPI Integration: Ensure your UPI ID is active and linked to a bank account with sufficient funds to cover the application amount.

Applying online through platforms like Agssl is efficient because:

Your demat account details are auto-populated, reducing manual errors.

The process is faster and can be completed from anywhere.

Real-time tracking of application status is available.

Applying for an IPO is a straightforward process if you have a demat account and access to the Agssl platform. By following the steps outlined above, you can participate in exciting investment opportunities with ease. Always conduct thorough research on the company and its IPO terms to make informed decisions. Start your investment journey today by opening a demat account with Agssl and exploring upcoming IPOs.

Complete Guide to the IPO Process in India: From Private to Public

Introduction: Why Do Companies Go Public?

An Initial Public Offering (IPO) is a major milestone in a company’s growth journey. It marks the transition of a privately held company into a publicly traded one, giving the general public an opportunity to invest in its shares. But the IPO journey is not just about selling shares — it’s about raising capital, building credibility, enhancing liquidity, and gaining access to wider financial markets.

The process of launching an IPO in India is comprehensive, highly regulated by the Securities and Exchange Board of India (SEBI), and must follow a structured, step-by-step path. If you’re a business owner considering an IPO or an investor wanting to understand the process, this guide is for you.

Key Reasons Companies Choose to Go Public

1. Raise Capital for Expansion

The primary motivation for going public is to raise significant capital to fund business growth — whether it’s expanding into new markets, launching new products, acquiring other companies, or simply reducing debt.

2. Increase Brand Credibility and Visibility

IPO listing boosts the public image of a company. It signals transparency and financial maturity, helping to build trust among customers, suppliers, and potential business partners.

3. Liquidity for Existing Investors

Private shares are illiquid and hard to trade. IPOs allow existing shareholders — founders, early investors, and employees — to convert their holdings into tradable shares, unlocking value and enabling exits.

4. Establish Market Value

When a company lists on the stock exchange, the market determines its value through share pricing and trading activity. This market-based valuation can assist in future fundraising, partnerships, and strategic decisions.

5. Access to Broader Financial Instruments

Once listed, a company can explore multiple fundraising routes beyond equity — including debt offerings, convertible securities, and rights issues. This opens up long-term strategic financial flexibility.

The IPO Process in India: A Step-by-Step Overview

Launching an IPO is a complex journey, typically taking 6–9 months, and involving several stakeholders, including legal advisors, auditors, merchant bankers, and market regulators. Here's a step-by-step breakdown:

Step 1: Appoint an Investment Bank or Underwriter

The first move is to hire one or more investment banks or underwriters. Their role is to evaluate the company’s financial health, determine capital requirements, structure the IPO, and assist in regulatory filings. They also take part in pricing the shares and marketing the IPO.

An underwriting agreement is signed that outlines the amount to be raised, types of securities to be issued, and responsibilities of all parties involved.

Step 2: Prepare DRHP and File with SEBI

The company and its advisors prepare a Draft Red Herring Prospectus (DRHP), a detailed legal document that includes:

Financial statements

Industry overview

Business and operational details

Promoter and management info

Risk factors and litigation history

Proposed use of IPO proceeds

The DRHP is submitted to SEBI and the Registrar of Companies (RoC). SEBI reviews it for compliance with the SEBI ICDR Regulations, and if required, returns it with comments for clarification or changes.

Once approved, the company can fix the IPO timeline and proceed to market the issue.

Step 3: Apply to Stock Exchanges

The company must now decide where it wants to list — typically on the NSE or BSE — and file the application accordingly. Exchange approval is mandatory for listing.

Step 4: Conduct Roadshows and Marketing

Next comes the roadshow phase — typically lasting 1 to 2 weeks — where senior management and investment bankers travel across cities, meeting with institutional investors like Qualified Institutional Buyers (QIBs).

This step helps generate buzz, build credibility, and gauge investor interest. The company showcases:

Growth story and future plans

Financial performance

Competitive advantages

Reasons to invest

Roadshows may be physical or virtual, and the feedback collected helps finalize pricing.

Step 5: Pricing the IPO – Fixed vs Book-Building

Companies can choose from two pricing mechanisms:

Fixed Price Issue

The price per share is decided in advance and disclosed in the prospectus. Investors know what they are paying at the time of application.

Book-Building Issue

A price band is provided (e.g., ₹100–₹120). Investors bid for shares within this range, and the final price is determined by demand. This method is preferred as it leads to better price discovery and more transparent allocation.

The final price is called the cut-off price, and shares are allocated accordingly.

Step 6: Offer Opens to the Public

Once pricing is finalized, the IPO opens for subscription — typically for 3 to 5 working days. Applications can be submitted online or offline through ASBA (Application Supported by Blocked Amount) via banks and brokers.

SEBI regulates IPO timing to avoid overlap with large competing offerings and to ensure retail investor protection.

Retail investors, QIBs, and Non-Institutional Investors (NIIs) all participate in different reserved quotas.

Step 7: Share Allotment and Listing on the Exchange

After the subscription window closes:

Applications are verified

Shares are allotted based on demand

Refunds are issued to non-allottees (in oversubscribed cases)

Shares are credited to investor demat accounts

Oversubscription is common. For instance, if the IPO is oversubscribed 5x, investors may receive only 20% of the shares they applied for.

The company then finalizes its listing date. On this day, its shares begin trading on the exchange.

Lock-In Periods and Post-IPO Market Dynamics

SEBI enforces a lock-in period for promoters and select investors, typically ranging from 6 months to 3 years, to prevent immediate stock dumping that could destabilize prices.

When the lock-in ends, short-term fluctuations may occur as shares hit the open market.

Also, IPO stock prices may fluctuate after listing, depending on market sentiment, investor perception, and broader economic trends.

Conclusion: IPO as a Strategic Growth Lever

Launching an IPO is not just a financial decision — it’s a strategic transformation. It requires transparency, operational excellence, and investor confidence. While the rewards are high — capital, credibility, liquidity — the risks are also significant if the process is not managed carefully.

If you're an investor or a business looking to understand the IPO journey, staying informed is key.

For detailed IPO reviews, latest listings, and company analysis, visit Agssl’s IPO review section.

Frequently Asked Questions (FAQs)

Q1. What is the difference between DRHP and RHP?

DRHP (Draft Red Herring Prospectus) is the initial filing with SEBI, while RHP (Red Herring Prospectus) is the final version issued before the IPO opens to the public.

Q2. Who can invest in an IPO?

Retail investors, QIBs (like mutual funds and banks), and Non-Institutional Investors (HNIs) can all apply for IPO shares.

Q3. What is oversubscription in IPOs?

It means more demand than available shares. In such cases, allotment is made proportionately or by lottery (in retail category).

Q4. How long does it take to go public in India?

Typically, 6–9 months, but it can vary depending on regulatory approvals and market readiness.

Understanding Intraday Trading: Strategies, Tips, and Benefits – by AGSSL

For those looking to actively participate in the stock market and capitalize on short-term price movements, intraday trading offers a compelling opportunity. Unlike traditional investing where you hold stocks for months or years, intraday trading focuses on buying and selling stocks within the same trading day. This means all positions are squared off before the market closes. In this blog, AGSSL breaks down everything you need to know about intraday trading — from its definition and key strategies to the tools and indicators that can help you succeed.

What is Intraday Trading?

Intraday trading, often referred to as day trading, is the process of purchasing and selling financial instruments (like stocks) within a single trading day. The primary objective isn't long-term wealth creation but to generate quick profits from the small fluctuations in stock prices that occur throughout the day.

When placing intraday trades, it is important to specify that your order is for intraday purposes. This tells your broker that you intend to close the position on the same day, avoiding the risk and exposure of holding stocks overnight.

Why Intraday Trading?

The appeal of intraday trading lies in its fast-paced nature and potential for rapid returns. Unlike long-term investing, which requires patience, intraday trading is dynamic and can yield results within hours or even minutes. However, with greater reward comes greater risk. That’s why AGSSL encourages traders — especially beginners — to approach intraday trading with caution and preparation.

AGSSL’s Essential Intraday Trading Tips for Beginners

For those new to the market, intraday trading can be daunting. But by following a few key principles, you can build a strong foundation:

1. Start with Small Capital

Begin with an amount you’re comfortable risking. This will allow you to gain experience without taking on undue financial pressure.

2. Use Stop-Loss Orders

A stop-loss order automatically sells your stock when it reaches a specific price, helping you limit potential losses. This is an essential risk management tool in intraday trading.

3. Don’t Chase the Market

Avoid making impulsive trades based on sudden market movements or news. Stay focused on your strategy.

4. Stay Updated with Market News

Always keep track of news that may affect the markets — such as company earnings, economic reports, or global events.

5. Stick to a Trading Plan

Develop a clear plan including entry and exit strategies and stick to it. Discipline is key in trading.

Key Intraday Trading Indicators to Know

Successful intraday trading relies heavily on technical analysis. Traders often use indicators — tools that analyse past and current price trends — to make informed decisions. Here are the most effective ones used by professionals:

Moving Averages (MA)

Helps identify the direction of the market trend by averaging out price data over a specific period.

Bollinger Bands

Shows market volatility and potential overbought or oversold conditions.

Relative Strength Index (RSI)

Measures the strength and speed of a stock’s price movement. An RSI above 70 may indicate overbought conditions, while below 30 may signal oversold.

Stochastic Oscillator

Compares a security’s closing price to its price range over a given time period. It’s useful for spotting trend reversals.

How to Maximize Profits in Intraday Trading

While profit-making is the goal, intraday trading is inherently volatile. Here are some AGSSL recommendations to help you trade more effectively and reduce risk:

Limit Your Risk

Never risk more than 2% of your total capital on a single trade. This keeps your losses manageable.

Choose High-Liquidity Stocks

Stick to stocks with high volumes. This makes it easier to enter and exit trades quickly without affecting the price.

Mind the Clock

The best time for intraday trading is typically between 11:00 AM and 1:00 PM, when the market stabilizes after the morning rush.

Set Realistic Targets

Define your profit goals and exit the trade when those targets are achieved. Greed often leads to missed opportunities.

Final Thoughts from AGSSL

Intraday trading isn’t for everyone, but for those willing to learn, it can be both exciting and rewarding. It requires discipline, a strong grasp of market indicators, and continuous learning. At AGSSL, we believe that with the right tools and mindset, anyone can improve their intraday trading skills and take advantage of market movements — one day at a time.

If you're interested in learning more about trading strategies or want to open an intraday trading account, AGSSL is here to help you every step of the way.

How to Pick the Best Stocks for Intraday Trading: A Complete Guide

Intraday trading, also known as day trading, is a popular method of market speculation where

traders buy and sell stocks within the same trading day. The goal is simple: take advantage of small

price movements to earn quick profits. But there's one golden rule that can make or break your

intraday trading success - stock selection.

Let's break down the key strategies and insights that will help you pick the best stocks for intraday

trading.

What is Intraday Trading?

In intraday trading, positions are opened and closed within the same day. For instance, if you buy

500 shares of Reliance at Rs.920 in the morning and sell them at Rs.928 by evening, you make a

profit of Rs.4,000 (500 x Rs.8). You can also short sell, i.e., sell first and buy later, to profit from

falling prices - a practice only possible through intraday trading.

Why Stock Selection Matters in Intraday Trading

Many traders fail to make profits because they pick the wrong stocks. Success depends on choosing

liquid, predictable, and volatile (but not overly erratic) stocks that respond to market trends and

news. Here are the key factors you must consider:

1. Trade Only in Liquid Stocks

Liquidity refers to how easily a stock can be bought or sold without impacting its price.

- Highly liquid stocks have large trading volumes, allowing traders to enter and exit positions with

ease.

- Illiquid stocks often lack enough buyers or sellers, making it hard to complete trades or causing

large price changes for even small orders.

Tip: Look for stocks that trade at least 50,000 to 75,000 shares per day if the price is between Rs.50

to Rs.100. For higher value stocks, you'll need even more volume.

Also, check liquidity at various price levels. A stock may be liquid at Rs.100 but illiquid at Rs.120.

Monitor such behavior to make smarter entries and exits.

2. Avoid Highly Volatile Stocks

Stocks with low volume or those affected by sudden news events can behave unpredictably. While

some volatility is essential for profit opportunities, too much can spell disaster.

- Most intraday traders look for stocks that move 3-5% in a day - not more.

- Avoid penny stocks and low-cap segments (like S, T, and Z groups), which often have both low

volume and high unpredictability.

3. Trade in Stocks with Good Correlation to Indices

Stocks that move in sync with their sector or index offer more predictability.

For example:

- A strengthening rupee might hurt IT stocks due to lower export earnings.

- Similarly, a surge in oil prices may impact aviation stocks.

Choose stocks that reflect the sentiment of their sector or the broader market for more reliable

trends.

4. Follow the Trend

Always trade with the trend, not against it.

- In a bull market, pick rising stocks.

- In a bear market, look for stocks that are declining and consider short selling.

Trend-based trading reduces risk and improves your chances of success.

5. Do Your Research

Good research is the backbone of profitable trading.

Here's a step-by-step strategy:

1. Identify the market trend - bullish or bearish.

2. Choose sectors showing strength or weakness.

3. Pick stocks within those sectors that show good volume and liquidity.

4. Use technical analysis - study support, resistance, and price action.

5. Check fundamentals and news triggers for extra insights.

Don't just follow tips or social media. Build your watchlist through data-backed analysis.

6. Check the Following Technical Criteria

a. Liquidity Ratio

- Use this formula: Liquidity = Average Daily Volume / Market Capitalization

- Look for a minimum 10% liquidity ratio to ensure smooth trade execution.

b. Impact Cost

- Impact cost is the price effect of placing a large buy or sell order.

- Low impact cost = better entry/exit prices.

c. Widely Owned Stocks

- Stocks with broad ownership are less prone to manipulation.

- Avoid stocks cornered by a few big players - they can hit circuit limits fast.

d. Narrow Tick Spread

- A smaller gap between buy and sell prices (ticks) means better pricing.

- In intraday trades, wide spreads can eat into profits quickly.

e. Clear Chart Patterns

- Look for stocks with visible trends or repeating patterns.

- Avoid stocks with inconsistent or unclear chart histories.

f. Sensitivity to News

- Good intraday stocks react quickly to earnings reports, economic indicators, or global events.

- This lets you capitalize on buy-on-rumor, sell-on-news strategies.

How to Pick Stocks Daily?

Here are some daily habits and filters to help you pick the right stocks:

- High Volume Stocks - Focus on shares with significant daily trading activity.

- News-Driven Stocks - Stocks with expected announcements or news events.

- Weekly Trends - Watch stocks showing consistent movement over the past 5 days.

- Breakout Stocks - Those breaching resistance levels with strong momentum.

- Stick to a Few Favorites - Master 5-10 stocks by tracking them daily.

- Watch Top Gainers/Losers - Use these lists to identify momentum trades.

Conclusion

Intraday trading is not just about speed - it's about strategy, discipline, and stock selection. The best

traders focus on:

- Liquidity

- Trend alignment

- Clear patterns

- News sensitivity

Over time, you'll train your eye to spot the right opportunities. Rely on technical analysis, ignore

emotional biases, and stick to data-driven decisions. With practice, your ability to pick the best

intraday stocks will become your greatest edge in the market.

AGSSL Tip: Use advanced trading platforms like AGSSL's Online Terminal to monitor stocks in

real-time, execute faster trades, and stay ahead of market moves - all from your browser.

Disclaimer: Intraday trading involves risk. Please consult with a financial advisor before investing.

.png)

How to Do NIFTY Intraday Option Trading?

Written by: Agssl

________________________________________

What is Intraday Trading?

Intraday trading refers to the buying and selling of stocks or derivatives (like options) within the same trading day. All positions must be squared off before market close.

Key Characteristics:

• Short-term strategy aiming for quick profits.

• No overnight risk since positions are closed same day.

• Higher leverage, but higher risk.

• Needs close monitoring of price movements.

________________________________________

What are Options?

Options are financial derivatives that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or at expiration.

Two Types of Options:

1. Call Option – Right to buy.

2. Put Option – Right to sell.

In intraday trading, NIFTY options are frequently used because of:

• High liquidity.

• Predictable price movements due to broader market indicators.

________________________________________

What is NIFTY?

NIFTY (National Fifty) is a stock market index consisting of 50 of the largest and most liquid stocks listed on the National Stock Exchange (NSE).

NIFTY Highlights:

• Reflects the overall market sentiment.

• Includes companies from 13 different sectors.

• Widely used for benchmarking mutual funds and ETFs.

Popular variants include:

• NIFTY 50 – The main index.

• BANK NIFTY – Represents 12 major Indian banks.

• FIN NIFTY, IT NIFTY, etc. – Represent specific sectors.

________________________________________

How to Trade NIFTY Options Intraday?

Intraday trading in NIFTY options involves taking short-term positions based on market trends, technical analysis, and momentum indicators.

Step-by-Step Guide:

Step 1: Choose a Reliable Broker

Use a brokerage platform that offers:

• Real-time charts

• Option chain analysis

• Low brokerage for intraday trades

Step 2: Use Technical Indicators

Common indicators include:

• Moving Averages (SMA/EMA)

• MACD

• RSI (Relative Strength Index)

• Bollinger Bands

• Volume Analysis

Step 3: Watch the Option Chain

Analyze:

• Open Interest (OI)

• Change in OI

• Implied Volatility (IV)

• Strike price selection based on trend direction.

Step 4: Time Your Entry and Exit

• Ideal trading hours: 9:30 AM to 11:30 AM and 1:30 PM to 3:00 PM

• Always use stop-loss to protect capital.

• Set target prices based on risk-reward ratios.

Step 5: Monitor Market Sentiment

Track:

• Global indices (NASDAQ, FTSE)

• FIIs and DIIs trading activity

• News updates & RBI policy

________________________________________

Tips for Successful Intraday Option Trading

1. Start with ATM or slightly OTM options for better liquidity.

2. Avoid trading in volatile news hours.

3. Use strict stop-loss and take-profit limits.

4. Don’t overtrade — pick 1–2 high-conviction trades per day.

5. Maintain a trading journal — review what works and what doesn’t.

________________________________________

Example: A Basic NIFTY Option Trade

• NIFTY is at 22,500.

• You expect a bullish breakout.

• You buy a 22,600 CE at Rs.120.

• Set a stop-loss at Rs.90 and target at Rs.180.

If NIFTY rises, the premium might shoot up to Rs.180+, giving you a 50%+ return intraday.

________________________________________

How to Invest in NIFTY (Long-Term Options)

For investors looking beyond intraday trading, NIFTY exposure is available through:

1. Index Funds

• Mutual funds that replicate the NIFTY 50 index.

• Passive, low-cost investing.

2. Exchange-Traded Funds (ETFs)

• Trade like stocks.

• Direct exposure to NIFTY’s performance.

3. Futures & Options

• For advanced traders.

• Ideal for short-term speculation and hedging.

________________________________________

Summary

Topic Key Point

Intraday Trading Buy & sell within the same day.

NIFTY Options Right to buy/sell index at fixed strike price before expiry.

Technical Tools RSI, MACD, Bollinger Bands, Volume, Option Chain.

Trading Hours Avoid first 15 mins & last 15 mins unless highly experienced.

Strategy Entry, Stop-Loss, Target, Risk-Reward, and Sentiment Analysis.

Best Practice Start small, follow discipline, journal trades, and focus on learning.

________________________________________

Final Thoughts by Agssl

NIFTY intraday option trading offers a powerful way to leverage market moves, but it’s not for the faint of heart. It requires a combination of analysis, discipline, and experience. Start with paper trading or small capital and focus on building consistency, not chasing profits.

Remember: Capital protection is more important than profit maximization.

Happy Trading!

— Agssl

Understanding High Net Worth Individuals (HNIs): A Comprehensive Guide by Agssl

Introduction

In the realm of wealth management and investment, the term High Net Worth Individual (HNI) holds significant importance. HNIs represent a unique segment of investors who possess substantial financial resources, enabling them to access exclusive investment opportunities and personalized financial services. This blog post, brought to you by Agssl, explores the definition of HNIs, their characteristics, investment strategies, and how Agssl supports this elite group in achieving their financial goals.

Who is a High Net Worth Individual (HNI)?

A High Net Worth Individual (HNI) is typically defined as an individual or family with liquid assets above a certain threshold. In India, the Securities and Exchange Board of India (SEBI) categorizes HNIs as investors who invest a minimum of ₹2 crore in financial instruments or hold a net worth exceeding ₹25 crore, with at least ₹10 crore in financial assets. Globally, the threshold may vary, often starting at $1 million in liquid assets, excluding primary residences.

HNIs are distinguished not only by their wealth but also by their sophisticated approach to investments. They often seek diversified portfolios, exclusive opportunities, and tailored financial advice to preserve and grow their wealth.

Characteristics of HNIs

HNIs exhibit distinct traits that set them apart from retail investors:

Investment Strategies for HNIs

HNIs adopt a range of strategies to manage and grow their wealth. Here are some key approaches:

How Agssl Supports HNIs

At Agssl, we understand the unique needs of HNIs and offer a suite of services designed to cater to their financial aspirations:

Why HNIs Choose Agssl

HNIs trust Agssl for several reasons:

Challenges Faced by HNIs

Despite their financial prowess, HNIs face unique challenges:

Conclusion

High Net Worth Individuals represent a dynamic and influential segment of the investment landscape. With their substantial wealth and sophisticated financial needs, HNIs require personalized strategies and exclusive opportunities to achieve their goals. At Agssl, we are committed to empowering HNIs with cutting-edge tools, expert advice, and a seamless investment experience. Whether you’re looking to diversify your portfolio, explore global markets, or plan for the future, Agssl is your trusted partner in wealth creation and preservation.

Ready to take your investments to the next level? Open an account with Agssl today or download the Agssl Super App to start your journey as an HNI. For more details, visit Agssl’s website or contact our wealth management team.

Disclaimer: Investments are subject to market risks. Please read all scheme-related documents carefully before investing. This blog is for informational purposes only and does not constitute financial advice.

Understanding Return on Equity (ROE): A Comprehensive Guide by AGSSL

Return on Equity (ROE) is a fundamental financial metric that evaluates a company’s profitability by measuring how much return is generated from shareholders’ investment. It indicates how efficiently a company is using the shareholders’ money to generate profits.

What is ROE?

ROE is calculated by dividing a company’s net profit by its net worth (also known as shareholders’ equity):

ROE = Net Income / Shareholders’ Equity

A high ROE indicates effective use of shareholder capital, while a low ROE suggests that the company is not efficiently utilizing its capital.

Generally, a company with ROE above 20% is considered a good investment.

Why Is ROE Important?

ROE is one of the key indicators used to assess a company’s financial health and profitability. Here’s why it's crucial:

Note: ROE should not be the sole parameter for investment decisions. It can be influenced by financial strategies like debt financing, which may artificially inflate the ROE.

How to Calculate ROE?

To calculate ROE:

ROE = Net Income / Shareholders’ Equity

Analysts often use trailing twelve months (TTM) income for a more accurate calculation. In some cases, free cash flow may be used instead of net income, although net income is more widely accepted.

Why Studying ROE is Significant

1. Represents Financial Soundness

A higher ROE often reflects better financial health and efficient management.

2. Analyzes Company’s Financial Growth

By comparing ROE over different time periods, investors can evaluate how consistently a company has grown.

3. Helps in Peer Comparison

ROE is effective in comparing companies within the same industry. Every sector has a benchmark ROE—comparing a company’s ROE with its industry average helps judge its competitive standing.

4. Gauges Company’s Growth

ROE trends reveal how well a company has used retained earnings to grow profits and shareholder value over time.

5. Detects Financial Irregularities

Drastic changes in ROE, especially spikes after periods of loss, may indicate inconsistencies or one-off events impacting earnings.

What High ROE Tells You

How to Use ROE

1. Estimate Sustainable Growth

Use ROE alongside the retention ratio to estimate a company’s future growth and dividend potential.

2. Evaluate Dividend Capability

High ROE suggests a company can afford consistent and potentially increasing dividend payouts.

3. Apply the DuPont Formula

The DuPont formula breaks ROE into three components:

ROE = (Net Profit Margin) × (Asset Turnover) × (Equity Multiplier)

= (Net Income / Sales) × (Sales / Assets) × (Assets / Equity)

This helps investors understand why ROE is high or low—whether it's due to profit margin, efficient asset use, or leverage.

Can ROE Be Negative?

Yes, ROE can be negative when:

Negative ROE isn’t always a red flag—it could reflect short-term investments or development phases. However, it requires cautious analysis as it might also indicate poor financial management or high debt burden.

Key Takeaways

Final Thoughts from AGSSL

At AGSSL, we encourage investors to make informed decisions by using robust financial tools like ROE—but never in isolation. Combine data with industry trends, company fundamentals, and risk assessments for the best results.

Understanding ROE is a step toward identifying financially sound companies with long-term wealth-generating potential.

Let me know if you'd like this formatted for your website (HTML/Markdown) or want to include charts, case studies, or sector-specific examples.

Understanding Large Cap, Mid Cap, and Small Cap Stocks: A Deep Dive by AGSSL