Immediate or Cancel (IOC) Orders: Comprehensive Overview

-

Jul-21-2025

Jul-21-2025

Immediate or Cancel (IOC) Orders: Comprehensive Overview | Agssl

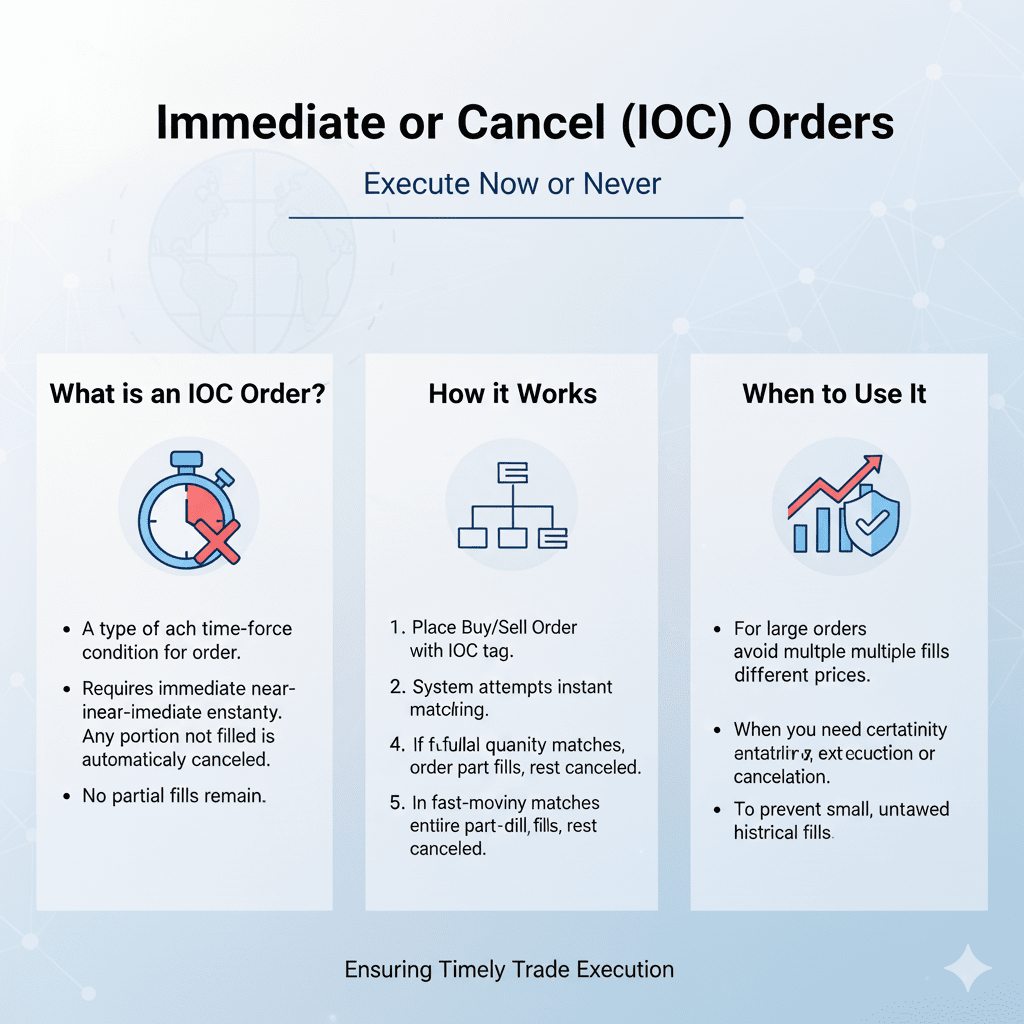

What is an IOC Order?

An IOC (Immediate or Cancel) order is a specialized instruction that allows traders to execute a buy or sell order instantly in the stock market. If the entire quantity cannot be executed right away, any remaining unfilled portion is cancelled—there’s no pending order left in the system. This zero-duration order is perfect for those who need rapid decision-making in fast-moving markets.

Key Characteristics of IOC Orders

- Instant Execution: The order is attempted immediately; whatever can be filled is executed, while the rest gets cancelled automatically.

- Partial Fills Allowed: Even if only part of the order is available, that part is executed.

- No Pending Risk: You never have to worry about forgotten or hanging orders at the end of the day.

- Order Types: IOC can be placed as both market (best available price) or limit (your set price) orders.

Advantages of Using IOC Orders

- Speed: Ideal for traders who require immediate execution—especially effective during periods of high market volatility.

- Efficiency in Bulk Trades: Lets you process large-volume trades discretely without showing your full intent to the market.

- Risk Management: Limits the exposure to price swings and ensures you don't pay more or sell for less than your set parameters.

- Flexibility: Suited for both large and small lots, helping you align trades with your overall strategy.

- No Manual Cancellation Needed: Reduces the risk of holding unexecuted orders due to oversight.

- Transparency: Provides clarity over what price and quantity has been filled.

Drawbacks of IOC Orders

- Incomplete Fills: Risk of only part of the order getting executed, especially in low-volume or illiquid stocks.

- Order Cancellation: Unfilled portions are lost—if nothing matches instantly, you get no transaction at all.

- Not for All Market Conditions: Less useful for long-term investors or when you have time to wait for optimal pricing.

- Complexity: Requires understanding of market conditions and potentially active management, particularly for larger or sophisticated trades.

- Possible Higher Fees: Some trading platforms may charge more for IOC order types due to their advanced functionality.

Practical Example

Suppose you want to buy 1,000 shares of Company Y at ₹200 each. The market only has 600 shares available at that price.

- Action: Place an IOC limit order to buy 1,000 shares at ₹200.

- Result: The platform fills 600 shares instantly and cancels the rest of the order for 400 shares (since those aren't available at that price).

When to Use IOC Orders

- When executing large trades in volatile or illiquid markets.

- If you're unable to consistently monitor the market but want to avoid having open, lingering orders.

- For situations where speed and instant confirmation are more important than getting the exact desired quantity.

- To discreetly target shares at a particular price without broadcasting your entire volume to the market.

Comparison: IOC vs. Other Order Types

|

Order Type

|

Duration

|

Fills/Partial Fills

|

Pending Risk

|

Suitability

|

|

IOC

|

Immediate

|

Yes

|

None

|

Fast trades, volatility

|

|

Day Order

|

Until market close

|

Yes

|

Possible

|

Waiting for target price

|

|

Fill or Kill (FOK)

|

Immediate

|

No, must be full

|

None

|

All-or-nothing trades

|

|

Good Till Cancelled (GTC)

|

Until executed/cancelled

|

Yes

|

Yes

|

Medium- to long-term

|

Conclusion

IOC orders give Agssl traders the flexibility, rapid execution, and risk management needed for modern markets. They’re best for users who value instant action and are comfortable with partial fills, especially in volatile environments or when handling large volumes.

For effective use, understand your trading goals, market liquidity, and risk tolerance—this will help you decide when an IOC order is the right tool for your investment strategy