Understanding the Difference Between Savings and Investment

-

Aug-04-2025

Aug-04-2025

Understanding the Difference Between Savings and Investment (agssl)

The Importance of Savings in Indian Households

Many Indians are taught from childhood the value of setting aside money. Whether through a piggy bank, traditional post office schemes, recurring deposits, or fixed deposits, the notion of “saving for the future” is deeply embedded in the national psyche. The focus has always been on security—keeping money safe for emergencies or future needs.

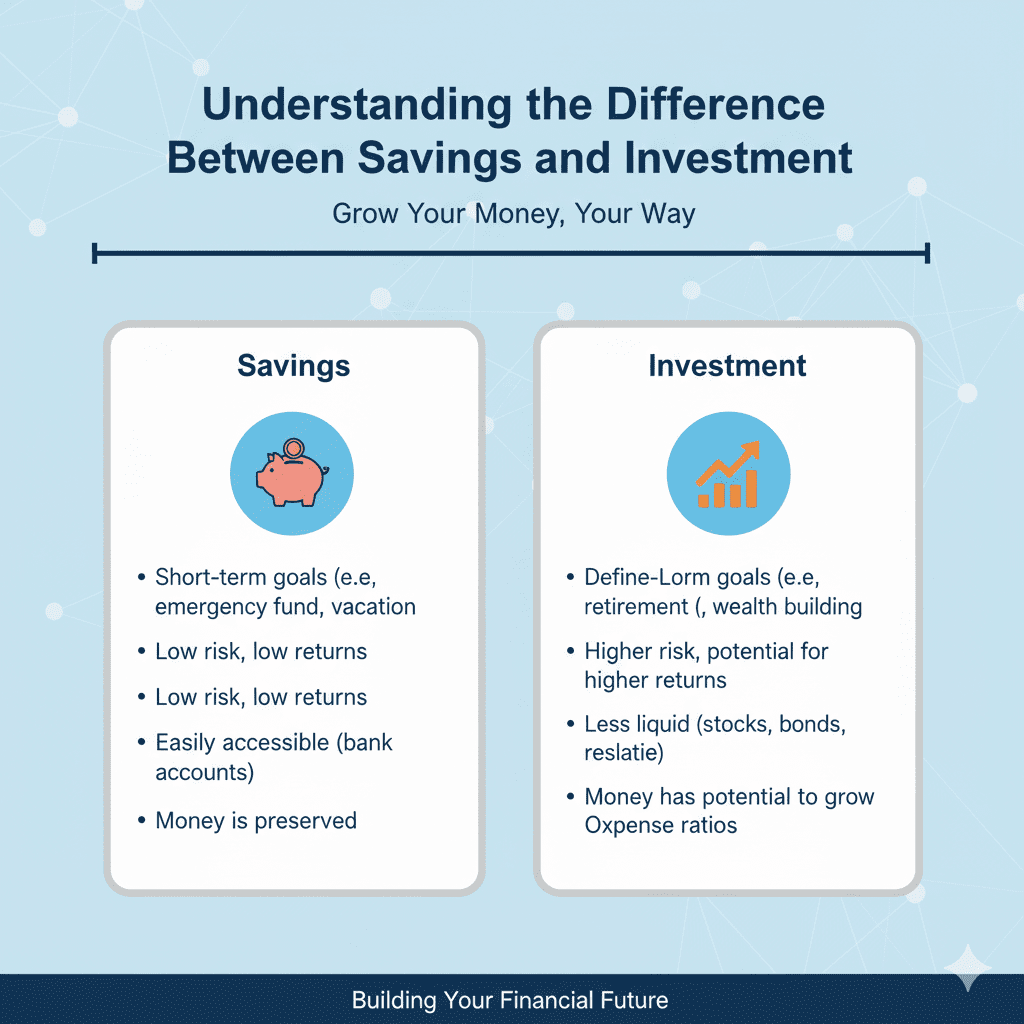

What Exactly Is Saving?

Definition:

Saving means intentionally not spending a portion of current income so it is available for future use.

Where Savings Are Held:

- Savings Accounts: Bank accounts intended for frequent deposits and withdrawals. Safe, but usually low interest.

- Fixed Deposits (FDs): You lock in money for a set period, earning higher (but still modest) interest than a regular account.

- Recurring Deposits (RDs): You put in a fixed amount every month for a fixed period; again, low risk and moderate returns.

- Cash at Home: Many households keep physical cash handy for emergencies.

Characteristics:

- High Liquidity: You can access your money quickly in most cases.

- Minimal Risk: Your principal amount is safe.

- Low Returns: Typically between 3–6% per annum, barely keeping pace with inflation in India.

What Does Investing Mean?

Definition:

Investing is using your money to purchase assets expected to grow in value or generate income over time.

Where to Invest:

- Equities (Shares/Stocks): Buy ownership in companies. Can yield high returns but risk is higher—prices fluctuate with markets.

- Mutual Funds: Professional managers pool investors’ money to buy stocks, bonds, or other assets.

- Bonds and Government Schemes: Includes PPF (Public Provident Fund), NSC, etc.—generally safer with predictable, moderate returns.

- Gold: Time-honored store of value, although prices may rise or fall sharply in the short term.

- Real Estate: Property values generally increase over the long term, but investments are large and liquidity is low.

Characteristics:

- Potential for Higher Returns: Historically, equities and equity mutual funds in India have delivered 10–12% annualized returns in the long run.

- Greater Risk: Market fluctuations can result in negative returns, especially in the short term.

- Longer Lock-in Periods: Some investments require your money to be invested for years to realize full growth potential.

- Beat Inflation: Investments are geared towards growing your wealth faster than inflation erodes it.

Key Differences: Savings vs. Investment

|

Aspect

|

Savings

|

Investment

|

|

Risk

|

Very low; principal is safe

|

Moderate to high, depending on instrument

|

|

Returns

|

Low (3–6% annually)

|

Moderate to high (can be 10–12% or more)

|

|

Liquidity

|

High; easy to withdraw or access

|

Varies; some are less liquid

|

|

Time Horizon

|

Ideal for short-term needs and emergencies

|

Best for long-term objectives

|

|

Purpose

|

Safety, security, short-term goals

|

Wealth building, outpacing inflation

|

Why Not Just Rely on Savings?

The Hidden Threat: Inflation

Inflation reduces the purchasing power of your money over time. If your savings grow slower than inflation, the real value of your money decreases.

Example:

- You save ₹1 lakh in an FD at 6%. After 5 years, you’ll have about ₹1.34 lakh.

- If you invest ₹1 lakh in a mutual fund returning 12% p.a., you’ll have nearly ₹1.76 lakh after 5 years.

- Difference: ₹1.76 lakh (investment) – ₹1.34 lakh (savings) = ₹42,000 higher returns, highlighting the power of compounding.

When Should You Focus on Saving?

- Short-Term Goals: Planning a vacation, upcoming marriage, or buying a gadget.

- Emergencies: It’s wise to keep 3–6 months’ worth of expenses in a savings account or FD for quick access if you lose a job or face a medical crisis.

- Risk-Averse Mindsets: If you are uncomfortable with the thought of losing money, keep a larger proportion of your funds as savings.

Remember:

Emergency funds are best kept in pure savings—easy to access and no risk of loss.

When Should You Prefer Investing?

- Long-Term Goals: Buying a house, funding a child’s education, or preparing for retirement.

- Wealth Accumulation: Only investment vehicles offer the kind of growth that outpaces inflation significantly over long periods.

- Harnessing Compounding: The earlier you start, the more you benefit from returns-on-returns (“compounding effect”).

How Should You Balance Savings and Investment?

Rule of Thumb: The 50-30-20 Approach

- 50% on Needs: Groceries, rent, utilities.

- 30% on Wants: Eating out, holidays, shopping.

- 20% on Savings and Investments: Out of this,

- Keep half (10% of income) in liquid savings/emergency fund.

- Invest the other half for long-term growth (e.g., SIPs in mutual funds).

Adjustments:

As your income grows or as life situations change, reallocate your proportions. Always prioritize building an emergency fund first, then gradually increase your investment allocation.

Major Pitfalls to Avoid

- Keeping everything in savings: Fails to outpace inflation; wealth builds too slowly.

- Investing blindly: Lack of research or understanding can result in big losses.

- Mixing goals: Use separate strategies for short and long-term aims; don’t put your emergency fund in volatile assets.

- Ignoring diversification: Spreading out investments can help lower overall risk.

Final Takeaways

- Do not perceive saving and investing as either/or; both are integral to a sound money strategy.

- Think of saving as your financial safety net for emergencies and short-term spending, and investing as your rocket engine for long-term wealth.

- Start small but start today. Even a minor monthly SIP (Systematic Investment Plan) in a mutual fund will make a big difference in the long run.

- As your financial position improves, increase both your savings and investments—in a disciplined, research-backed way.

- Ultimately, the best outcomes arise from making your money work for you, not just from how much you earn.

By applying these principles and regularly reviewing your financial plan, you'll harness both safety and growth, laying a solid foundation with agssl for your financial future.