What Is SIP Investment and How Does It Work? A Complete Guide by AGSSL

What Is SIP in Mutual Funds?

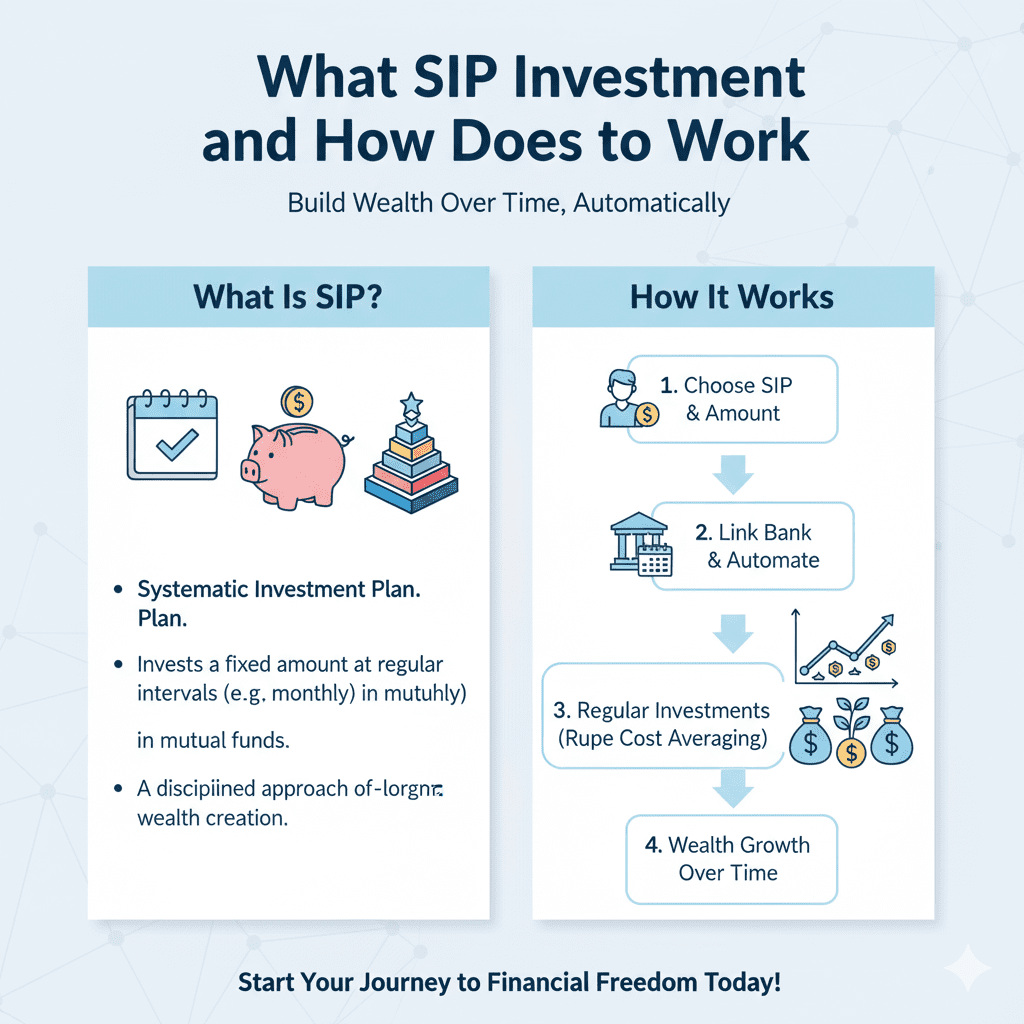

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where an investor opts for a mutual fund scheme and invests in it at fixed intervals.. A SIP investment plan works by investing a small amount of money over time rather than investing a one-time huge amount that could result in higher returns..

How Does a SIP Work?

Once you opt into a systematic investment plan, the amount will be automatically debited from your bank account and reinvested in a mutual fund you purchase at some predetermined time interval.. By the end of the day, you will be allocated units of your mutual fund that depend on its net asset value..

With every investment into an SIP plan in India, any additional units will be added to your account as per the market rate.. With every investment that is made, the amount that you reinvest will be larger in addition to any of the returns that you see on those investments.. The investor decides whether or not to receive the returns at the end of the SIP's tenure or any periodic intervals..

Understanding SIP Through an Example

Assume that you want to invest in a mutual fund of your choice and set aside a sum of ₹. lakh to invest.. There are two ways to make this investment:

Let's say you choose ₹500 monthly SIP with current Net Asset Value (NAV) of ₹.00.:

|

Month |

Investment Amount (₹) |

NAV |

Units Allotted |

Total Units |

|

0 |

500 |

.00 |

5 |

5 |

|

. |

500 |

.25 |

4 |

9 |

|

2 |

500 |

.00 |

5 |

.4 |

|

3 |

500 |

200 |

2.5 |

.6.5 |

₹500 will be deducted from your account each month and automatically credited into the mutual fund at a fixed date every month.. This process continues for the duration you have selected for your systematic investment plan..

Types of Systematic Investment Plans

Top-up SIP

This type enables you to increase your investment amount periodically while giving you the flexibility to invest more when you have a higher income.. It helps make the most out of investments by investing in high-performing funds at regular intervals..

Flexible SIP

As suggested by its name, this type carries the flexibility of the amount you want to invest.. The amount can be increased or decreased based on an investor's cash flow and needs or preferences..

Perpetual SIP

This type enables you to carry out your investments without any end to the mandate date.. Generally, a systematic investment plan carries an end date after one year, three years, or five years of investing..

Benefits of SIP Investing

Makes You a More Disciplined Investor

In case you do not possess superior financial knowledge about market movements, an SIP can make the ideal investment option.. You need not spend time analyzing market movements to find the right time to invest.. With an SIP, your money is automatically deducted from your linked bank account and goes towards your mutual funds..

Rupee Cost Averaging

One of the main advantages of SIPs is rupee cost averaging.. Since the amount you invest remains constant for a longer time period, you can make the most of market volatility.. The fixed amount implies that your SIP will average out the value of each unit, allowing you to buy more units when the market is low and fewer units when the market is high..

Power of Compounding

SIPs allow the small amount you invest on a regular basis to grow into a large corpus as a sum of your contribution with returns that have compounded over the years.. The power of compounding without the hassle of having to invest a lump sum amount gives SIPs a unique advantage over standard investment options..

When To Invest in SIP?

Investing in SIPs can be a strategic decision that aligns with your financial goals and risk tolerance.. SIPs are well-suited for individuals with a long-term investment horizon who want to benefit from the power of compounding..

If you have specific financial goals like buying a house, funding your child's education, or planning for retirement, starting a SIP early allows you to accumulate wealth gradually over time.. Market conditions should not be the sole determinant for starting an SIP since they involve regular and disciplined investing that helps smooth out the impact of market volatility through rupee-cost averaging..

How To Choose a Good Mutual Fund for SIP?

The answer lies in identifying why you are investing and what the goal is.. Consider these factors:

Rather than focusing on a "best" mutual fund for SIP, focus on what fund aligns with your investment principles and timeframe.. No best fund suits everyone; there is only what is best for you..

Best Performing Mutual Funds

|

Name |

AUM (₹ in crore) |

Expense Ratio |

CAGR 3Y (%) |

CAGR 5Y (%) |

|

ICICI Pru Overnight Fund |

.0,098.72 |

0.. |

.25.88 |

65.97 |

|

Quant Small Cap Fund |

..,206.76 |

0.77 |

46.6. |

33.74 |

|

Bank of India Small Cap Fund |

8.9.5. |

0.87 |

35.54 |

32.60 |

|

Quant Infrastructure Fund |

.,.30.39 |

0.77 |

4..92 |

32.04 |

|

Quant ELSS Tax Saver Fund |

4,956.53 |

0.76 |

35.0. |

30.89 |

Note: The list of best performing SIP mutual funds are as of January ., 2024 and are selected based on the 5-year CAGR..

How To Invest in SIP With AGSSL?

You can easily start a Mutual Fund SIP on the AGSSL app by taking the following steps.:

SIP Frequency Options

There are different frequencies available for SIP investments.:

Points to Consider While Selecting SIP Frequency

Common Myths About SIPs

Not for Large Investors

Myth: SIP plans are only for small investors..

Reality: SIP has more to do with frequency of payments than total amount. Anyone can invest up to ₹. lakh provided KYC is completed..

Don't Invest When Market is Bullish

Myth: You shouldn't invest in SIP during bull markets..

Reality: SIP relies on rupee cost averaging which works well over the long term, regardless of market conditions..

SIPs Are Not Flexible

Myth: SIP investments cannot be changed or discontinued..

Reality: SIP is among the most flexible investment instruments available. You can easily alter the amount and tenure with no penalties for changes..

Returns Are Guaranteed

Myth: SIP investments guarantee profitable returns..

Reality: While no investment can guarantee returns, SIPs stand a better chance of earning returns through rupee cost averaging over longer periods..

Only for Equity Markets

Myth: SIPs only invest in equity stocks..

Reality: You can choose which kind of security to invest in through your SIP plan based on your goals and risk profile..

Tax Benefits of SIP

Tax benefits on SIP depend on the type of fund.. SIPs invested in Equity Linked Savings Scheme (ELSS) funds are eligible for tax deductions.. As per Section 80C of the Income Tax Act, investors are eligible for a deduction of up to ₹..5 lakh..

Conclusion

SIPs are useful instruments, especially for investors who want to invest periodically in small amounts.. However, before you invest in an SIP, make sure you have the minimum knowledge about both the stock market and the strategy of the fund managers..

Is SIP suitable for beginners? Yes, SIP is suitable for beginners as it allows gradual investment, doesn't require a lump sum, and provides a disciplined approach to wealth creation.. The minimum investment can range from as low as ₹.00 to ₹500 or more, depending on the mutual fund scheme you choose..

Open a Demat Account with AGSSL today and learn about stocks, SIPs, mutual funds, and more investment opportunities to build your wealth systematically.