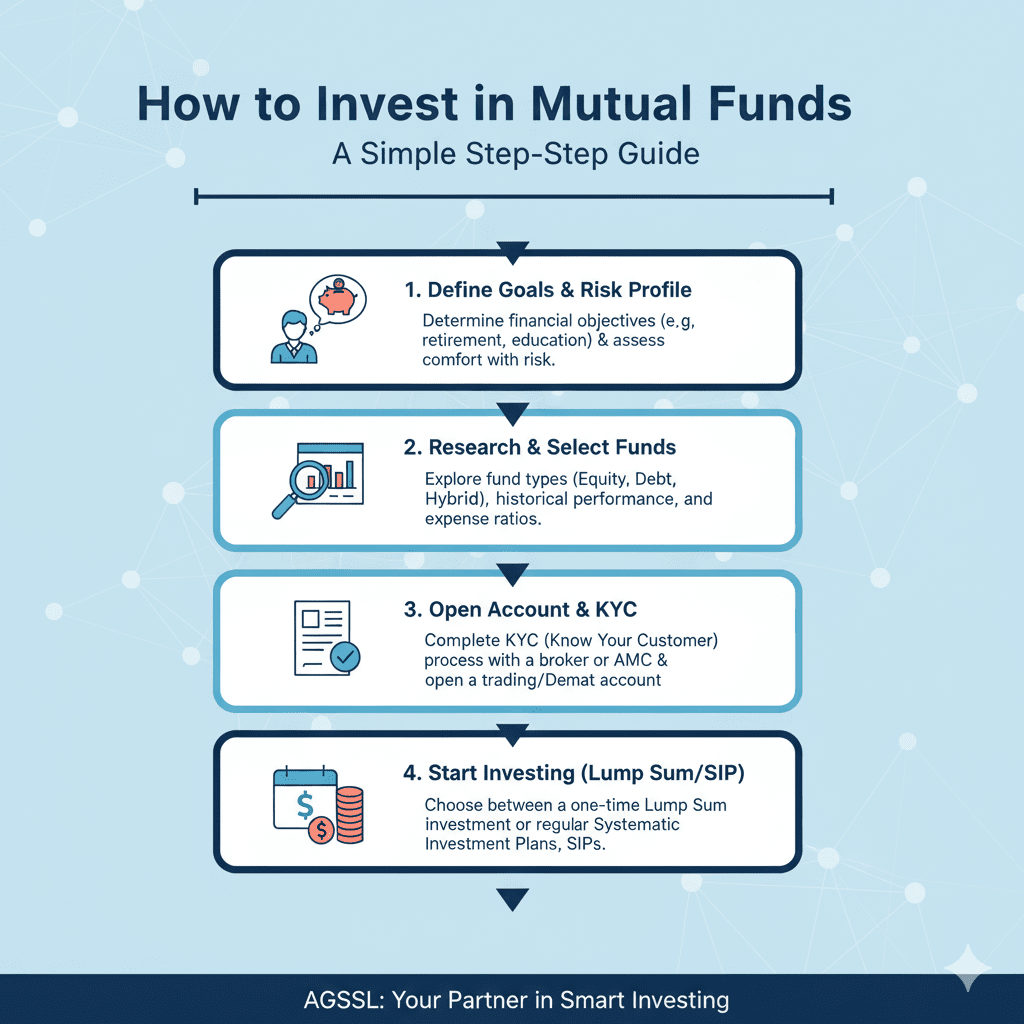

How to Invest in Mutual Funds

1. Understand Your Investor Profile

Before investing, assess your risk appetite, financial goals, and investment horizon. Longer-term investments generally offer higher returns, but they may involve more risk.

2. Choose the Right Type of Fund

There are different types of mutual funds to match investor needs:

When choosing, consider factors like expense ratios, past performance, and risk-adjusted returns.

3. Monitor & Rebalance Your Portfolio

Investing doesn’t end with buying a fund. Regularly track your portfolio’s performance and rebalance it if needed to ensure it aligns with your goals and risk profile.

KYC (Know Your Customer) Made Simple

To invest in mutual funds, you must complete KYC (Know Your Customer). The process is simple, digital, and once you complete CKYC (Central KYC), it applies across all investments.

Where to Buy Mutual Funds Online

With AGSSL, you can explore various mutual fund options, such as:

Advantages of Mutual Funds

1. Diversification

Mutual funds spread investments across different assets, reducing risk compared to investing in individual stocks.

2. Liquidity

Open-ended funds allow investors to redeem units anytime. Only ELSS (Equity Linked Saving Schemes) have a 3-year lock-in.

3. Customizability

Funds can be selected to suit your personal goals and risk tolerance.

4. Safety & Transparency

All mutual funds are regulated by SEBI and AMFI. Risk levels are color-coded:

5. Cost-Effectiveness

Mutual funds pool costs across investors, making them cheaper than direct stock trading.

6. Tax Benefits

ELSS funds provide tax deductions under Section 80C (up to ₹1.5 lakh annually) and offer higher return potential than many fixed-income tax-saving options.

7. Lower Lock-in Period

Compared to PPF or ULIPs, ELSS has just a 3-year lock-in period, offering greater flexibility.

8. SIP Advantage

Systematic Investment Plans (SIPs) help investors average costs over time and avoid the need to time the market.

9. Well-Regulated & Trusted

Mutual funds are governed by SEBI and AMFI, ensuring investor safety and transparency.

Conclusion

Mutual funds offer a balanced, cost-effective, and transparent way to grow your wealth while matching your risk profile and financial goals. Whether you’re a first-time investor or an experienced one, mutual funds can play a vital role in your financial planning.

Call-to-Action

Ready to grow your wealth with smart investments?

👉 Start your mutual fund journey with AGSSL today.