Title:

The Future of Cryptocurrency: How Digital Assets Are Reshaping Global Finance

The Future of Cryptocurrency: What’s Coming Next?

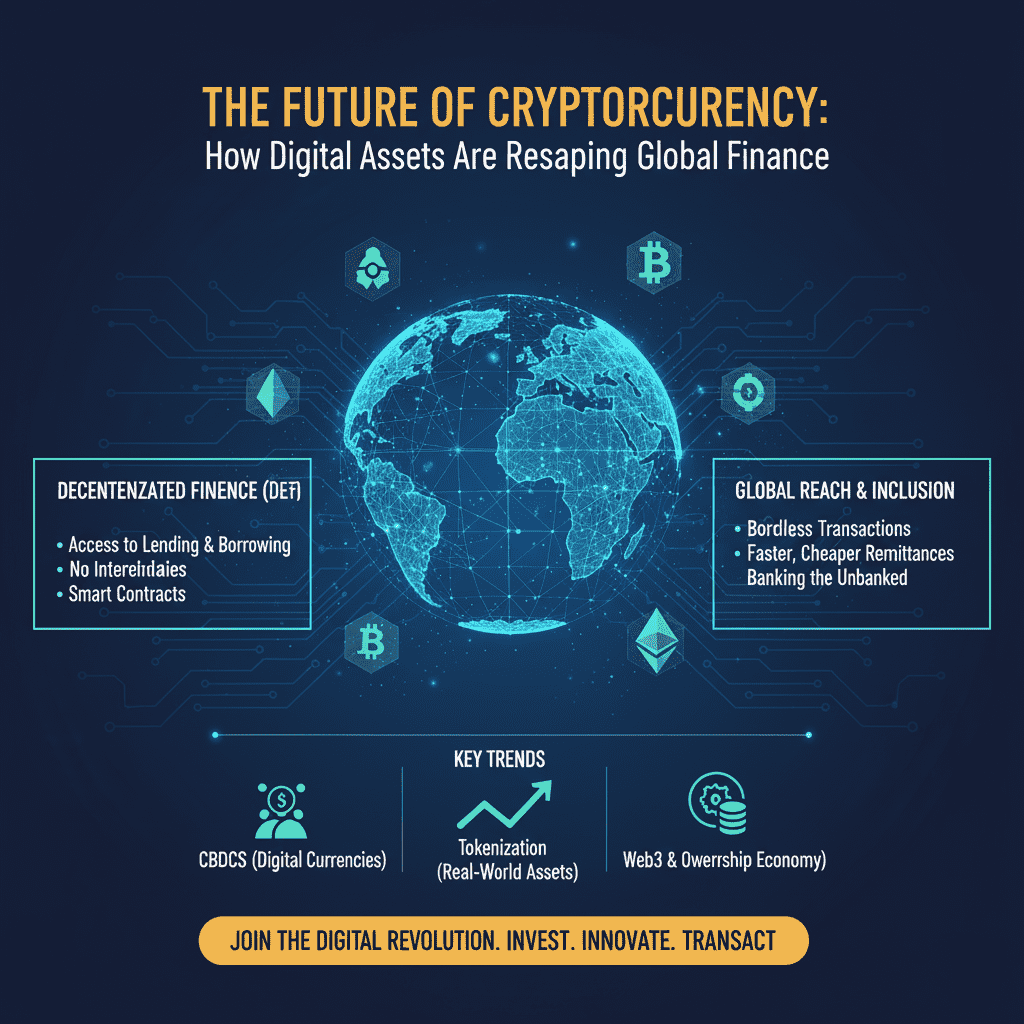

The crypto ecosystem isn’t just another finance trend — it’s becoming a full-stack digital movement that rewires how value moves across the world. From decentralised networks to tokenised assets, crypto continues to push the boundaries of traditional finance. But its future? That’s where things get interesting.

Let’s break it down in a way that’s data-driven, forward-looking, and business-ready.

What Exactly Is Cryptocurrency?

Crypto is a fully digital asset class built on blockchain — a decentralised, cryptographically secured ledger. No central bank. No physical notes. Just code, consensus, and transparent transactions.

Bitcoin proved the use-case early on, and since then the market ballooned from roughly USD 923 million to USD 6.6 billion by 2021. Adoption has only accelerated since.

Why Crypto Still Has Strong Tailwinds

Crypto’s not hype anymore — it’s infrastructure. Here’s the value proposition:

• Peer-to-peer transfers cut out banks and middlemen.

• Cryptographic security + decentralized networks = high trust, low dependency.

• Lower transaction fees vs. traditional rails.

• Capped supply assets (like Bitcoin) hedge against inflation.

• No single point of control, giving users true autonomy over value.

The more digital the world becomes, the more these advantages compound.

Where Crypto Still Struggles

Not everything is sunshine and moonshots:

• Volatility remains a major investor risk.

• Regulation gaps cause uncertainty.

• No intrinsic backing for some tokens creates valuation ambiguity.

• Scalability concerns — national monetary systems aren’t designed for sudden crypto dominance.

The industry is evolving, but the growing pains are real.

The Global Future of Cryptocurrency

The next five years are set to be transformative:

• Regulators worldwide (like the U.S. SEC) are building clearer frameworks.

• Blockchain adoption keeps rising as companies embrace digital-first operations.

• Bitcoin’s long-term narrative still points toward a six-figure valuation horizon.

• Commodity and asset tokenisation is projected to explode, digitising everything from gold to real estate.

• Financial inclusion will accelerate as micro-transactions and low-cost transfers go mainstream.

• Tax transparency improves as more transactions move to traceable digital systems.

Overall: Expect crypto to mature from a speculative asset to a core layer of digital finance.

The Future of Crypto in India

India is still in a transitional zone.

The proposed Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 signalled intent — but regulators are moving cautiously. With RBI prioritising monetary stability, the next 3–5 years may stay conservative.

Key signals:

• India isn’t ready for full-scale adoption yet.

• Regulatory clarity will decide how fast institutions move.

• Infrastructure adoption (including CBDCs) will drive the next big leap.

India’s crypto future is more about structured evolution than overnight transformation.

What This Means for Investors & Financial Institutions

If you’re in the markets (like AG Team’s ecosystem), here’s the playbook:

• Stay updated on regulation, not just price charts.

• Treat crypto as part of a larger digital-asset stack — DeFi, tokenisation, digital KYC, smart contracts.

• Expect new product lines in brokerage, custody, advisory, and payments as markets mature.

• Focus on risk frameworks — volatility management, compliance, and digital asset due diligence.

• Get infrastructure-ready for hybrid systems where traditional finance + blockchain interact seamlessly.

The institutions that adapt early will dominate the next growth cycle.

Final Outlook

Crypto isn’t replacing the financial system — it’s reinventing the plumbing beneath it. The next decade will be about convergence, regulation, and smarter use-cases rather than hype cycles.

For India, policy clarity will be the key unlock. For global markets, innovation keeps accelerating. For investors, the opportunity lies in understanding both risk and evolution.

And for financial leaders like you? This is the time to build capability — not wait.