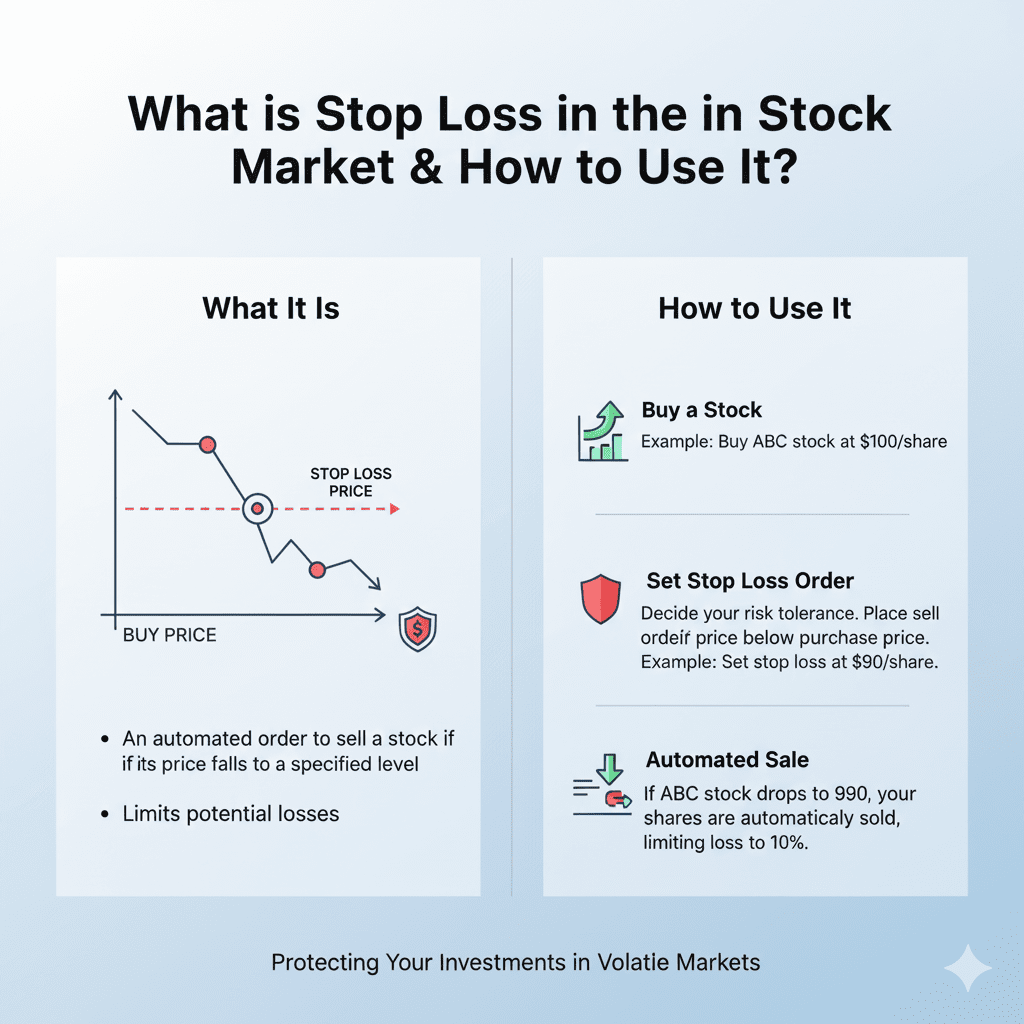

A stop-loss is a trading tool designed to limit potential losses by automatically selling a security when it reaches a preset price. It plays a vital role in helping traders manage risk and maintain trading discipline. In this blog post, we explore the concept of stop-loss, how to set it, its pros and cons, and its importance in investment strategies.

Meet Vinod, a beginner in the stock market who is trying to understand the concept of stop-loss. His friend Ashish, an experienced trader with AGSSL, explains:

A stop-loss is a predefined order to sell a security once it reaches a certain price, limiting the investor’s losses. For instance, Ashish buys 50 shares of ABC Mobiles at ₹1,000 per share. If the price falls to ₹960, he might decide to limit his losses and place a stop-loss order at ₹950. If the stock hits that price, AGSSL will automatically sell his shares, helping him avoid further losses.

On the flip side, if the stock rises to ₹1,400, Ashish might set a trailing stop-loss at ₹1,300 to protect his gains. This strategy allows him to lock in profits while reducing the risk of losing them if the price drops unexpectedly.

Before placing a stop-loss order, consider the following factors:

Determine how much of your capital you are willing to risk on a trade. This percentage helps in deciding an appropriate stop-loss level.

Low-volume stocks can be harder to exit even with a stop-loss in place due to the absence of buyers at the set price.

Larger trades in illiquid stocks can be risky. Ensure the position size matches the stock’s average traded volume.

Highly volatile stocks require a wider stop-loss to avoid premature exits. For less volatile stocks, tighter stop-loss limits can be effective.

Use support and resistance levels, moving averages, and trendlines to set stop-loss orders. A common method is placing the stop-loss just below a support level.

ATR measures market volatility. Many traders use a multiple of ATR to set stop-loss distances, ensuring they account for typical price swings.

If the market is volatile or big news is expected, consider setting wider stop-losses to avoid being exited prematurely.

Test your stop-loss strategy using historical data. Backtesting helps in refining your approach before applying it in live markets.

Pro Tip: Once you set a stop-loss, stick to it. Avoid making emotional decisions during market movements.

Minimizes Losses: Helps preserve capital by capping losses on bad trades.

Improves Risk Management: Encourages disciplined trading and protects long-term investment goals.

Eliminates Emotional Decisions: Prevents panic-based decisions by automating exits.

Triggered by Volatility: Market noise can activate stop-losses, causing premature exits.

Slippage: Orders may execute at a worse price than intended, especially in fast-moving markets.

Price Gapping: Sudden price jumps during market events can skip the stop-loss level entirely.

Psychological Impact: Constantly adjusting stop-loss orders can create anxiety and second-guessing.

Stop-loss orders are an essential part of any investor's toolkit. They provide a safety net during volatile market conditions and offer peace of mind by automating the selling process at predetermined levels. For long-term investors and traders alike, stop-losses foster discipline and prevent catastrophic losses that could derail financial plans.

By reducing the emotional component of trading, they enable investors to focus on strategic decisions rather than reacting impulsively to market swings.

Despite their utility, stop-loss orders are not foolproof:

They don’t account for fundamentals or news events—only price.

Execution may be difficult in low-liquidity or highly volatile markets.

In rare situations, such as flash crashes, stop-losses may not offer complete protection.

To use stop-losses effectively, they should be combined with broader market analysis and a clear trading strategy.

A stop-loss is an essential risk management tool that helps traders and investors minimize potential losses while protecting gains. Whether you are a novice like Vinod or an experienced investor like Ashish, understanding how and when to use stop-loss orders can lead to more disciplined, confident, and successful investing.