Sub-Broker vs Franchise: Understanding the Differences

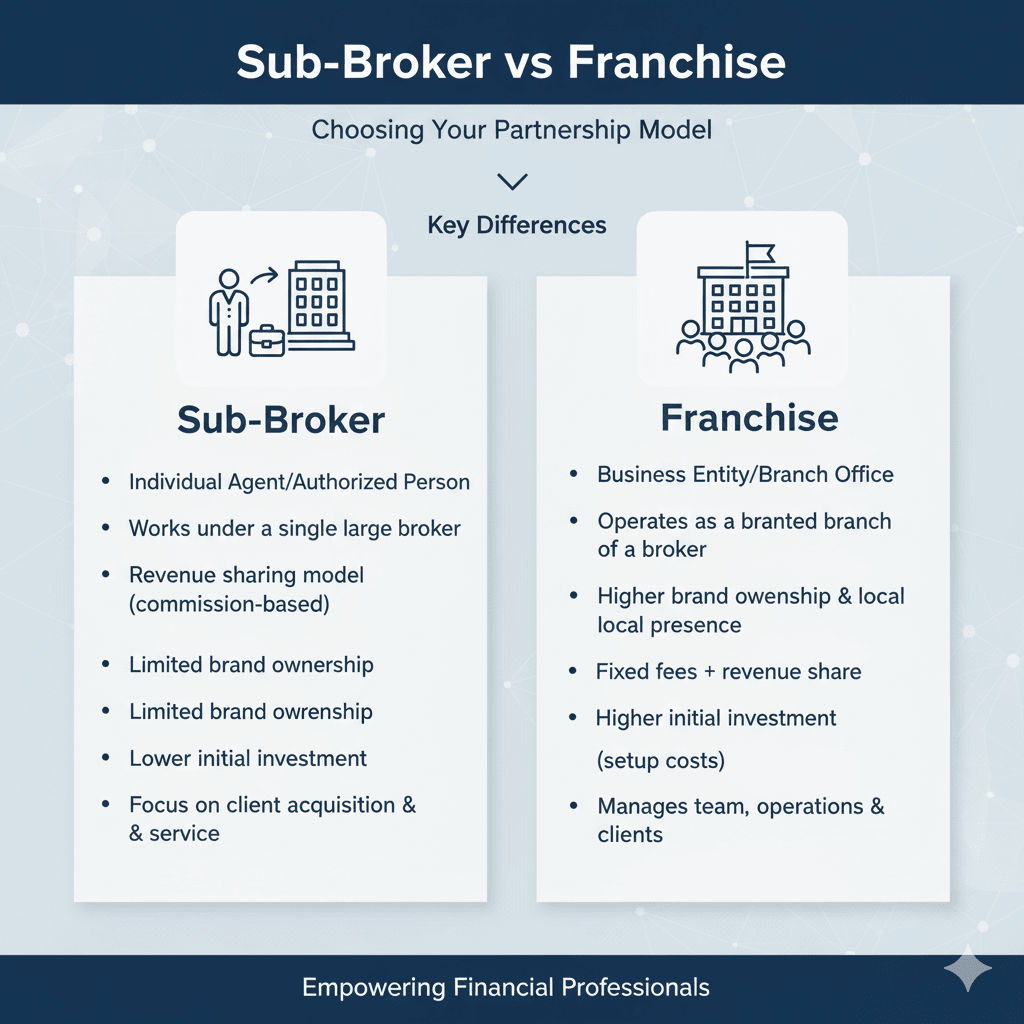

When it comes to the world of stockbroking partnerships, two models often create confusion: the Authorized Person (earlier known as Sub-Broker) and the Franchise. While both help brokerage firms expand their reach, they differ significantly in their operations, requirements, and benefits. This blog will help you clearly understand the distinctions, with references from AGSSL’s knowledge center and other industry perspectives.

Who is an Authorized Person (Sub-Broker)?

An Authorized Person (AP), previously called a sub-broker, is an individual or entity that works as an agent of a broking house. They are not directly registered with the stock exchange.

What is a Franchise?

A Franchise operates under the brand and license of a large broking house, like AGSSL, following defined commercial terms.

Comparative Analysis: Authorized Person vs Franchise

|

Aspect |

Authorized Person (Sub-Broker) |

Franchise |

|

Registration |

Registers only with the broking house; SEBI registration not required |

Registers as AP and signs commercial agreement with broker |

|

Branding |

Operates under own name |

Operates under AGSSL’s brand |

|

Support & Training |

Limited or self-managed |

Extensive training, marketing, and technical support |

|

Onboarding Needs |

Minimal requirements, just registration and basic capability |

Requires office, infrastructure, deposits, and agreements |

|

Earnings Model |

Earns commission per trade, highly flexible |

Income depends on contract and commercial terms |

|

Reputation |

Must build credibility independently |

Leverages AGSSL’s established reputation |

Industry Context

Other broking industry players highlight the distinction in similar ways:

Other Business Partner Models

Apart from APs and Franchises, AGSSL’s ecosystem includes other models:

Final Thoughts

Both the Authorized Person and Franchise models offer unique advantages.

Your choice ultimately depends on your long-term business goals—whether to grow independently or scale under the strong network of a reputed firm like AGSSL.

Join AGSSL as a Partner

At AGSSL, we provide multiple business partnership opportunities tailored for ambitious professionals. Whether you wish to start small as an Authorized Person or build a larger presence as a Franchise, our strong brand, training support, and modern tools will empower your journey.

Take the next step toward financial growth with AGSSL.

[Become a Partner with AGSSL Today →]

Frequently Asked Questions (FAQs)

1. What is the main difference between a Sub-Broker (Authorized Person) and a Franchise?

A Sub-Broker or Authorized Person registers with a broking house and earns commissions per trade. A Franchise, on the other hand, works under the broker’s brand (like AGSSL), with stricter onboarding requirements and more structured support.

2. Which model is more profitable: Sub-Broker or Franchise?

Profitability depends on scale. Sub-Brokers have lower entry costs and flexible earnings, while Franchises, with higher investment, can benefit from brand power and structured growth, often leading to higher long-term income.

3. Do Sub-Brokers need SEBI registration?

No. Under current regulations, Sub-Brokers (Authorized Persons) only need to register with a broking house like AGSSL, not directly with SEBI.

4. Can I start as a Sub-Broker and later become a Franchise?

Yes. Many individuals start as Sub-Brokers to understand the business, build a client base, and then scale up to a Franchise model when ready for greater investment and expansion.

5. Why should I choose AGSSL for partnership?

AGSSL offers strong brand credibility, advanced trading platforms, marketing support, and comprehensive training, making it an ideal partner for both Sub-Brokers and Franchises.